saitpro100.ru

Learn

Helium Hnt Token Miner

Helium has migrated to Solana. All LoRaWAN Hotspots now mine IOT, while HNT is emitted into the subnetwork Treasury. IOT Holders can redeem their IOT for HNT. How to earn with Helium mining The amount of HNT tokens you earn depends on the number of miners in your location, the device data your hotspot transfers, the. The RAK Hotspot V2 is a Helium Hotspot for Helium mining or HNT Mining with Blockchain IoT that works as an outdoor LoRa® gateway with extensive coverage. MNTD Helium (HNT) miner is a new brand by RAKwireless to make crypto hardware accessible to everyone. Provide Wireless Connectivity and Mine Helium Tokens. Mining Helium tokens (IOT and MOBILE) is done by installing a simple device on your home or office window. The crypto community knows Helium Miner as the first-ever decentralized wireless network that allows HNT mining. The helium network is made up of long-range. The more HNT I mined, the less it was worth. All of the ROI calculations depend on stable coin values. Profiting off of Helium was a pipe dream. Helium (HNT) is a decentralized blockchain-powered network for Internet of Things (IoT) devices. Launched in July , the Helium mainnet allows. Helium miners use radio frequencies to create a network, and miners receive HNT (Helium Network Tokens) in return. Good news! Helium mining does not require. Helium has migrated to Solana. All LoRaWAN Hotspots now mine IOT, while HNT is emitted into the subnetwork Treasury. IOT Holders can redeem their IOT for HNT. How to earn with Helium mining The amount of HNT tokens you earn depends on the number of miners in your location, the device data your hotspot transfers, the. The RAK Hotspot V2 is a Helium Hotspot for Helium mining or HNT Mining with Blockchain IoT that works as an outdoor LoRa® gateway with extensive coverage. MNTD Helium (HNT) miner is a new brand by RAKwireless to make crypto hardware accessible to everyone. Provide Wireless Connectivity and Mine Helium Tokens. Mining Helium tokens (IOT and MOBILE) is done by installing a simple device on your home or office window. The crypto community knows Helium Miner as the first-ever decentralized wireless network that allows HNT mining. The helium network is made up of long-range. The more HNT I mined, the less it was worth. All of the ROI calculations depend on stable coin values. Profiting off of Helium was a pipe dream. Helium (HNT) is a decentralized blockchain-powered network for Internet of Things (IoT) devices. Launched in July , the Helium mainnet allows. Helium miners use radio frequencies to create a network, and miners receive HNT (Helium Network Tokens) in return. Good news! Helium mining does not require.

Helium is described as a blockchain-based network for IoT devices that uses nodes as Hotspots to connect wireless devices to the network. The native token HNT. Helium miners use radio frequencies to create a network, and miners receive HNT (Helium Network Tokens) in return. Good news! Helium mining does not require. HNT token price action or participated in Helium mining activities in That's the year when Helium stepped into the spotlight as one of the most. Helium Decentralized Wire Network (DWN) enables wireless access to the internet for devices by way of several independent miners. The DWN also specifies the. Helium FreedomFi 5G Gateway Miner for Mobile/IoT/HNT Tokens | Works with Helium-Certified CBRS Small Cell Radios | for use in USA Only - Offered by MinerWorks. Mining Helium tokens with Hotspots is done via radio technology, not expensive or wasteful GPUs. Build Networks. Hotspots work together to form a new global. Earn HNT cryptocurrency by mining Helium and building coverage for The People's Network using the Nebra HNT Outdoor Hotspot Miner. Check each product page for other buying options. Helium FreedomFi 5G Gateway Miner for Mobile/IoT. Deeper Network HNT Miner is an loT device from Deeper Network that is compatible with Helium LongFi, combining the wireless LongFi protocol and Helium. The Dragino HP0C Indoor Helium HNT Hotspot Miner is a high-performing, ready-to-use LoRaWAN indoor hotspot for Helium Network HNT mining. Helium mining involves the process of validating and securing wireless IoT networks by deploying specialized hardware called helium miners. Milesight IoT UG65 Helium (HNT) Hotspot Miner. $ – $ excl. TAX. Milesight IoT UG67 Helium (HNT) Hotspot Miner. $1 excl. TAX; SOLD OUT COMING. By mining Helium, you contribute to this global network and can earn HNT (the cryptocurrency associated with Helium). How Does Helium Mining Work? Helium. By mining Helium, you contribute to this global network and can earn HNT (the cryptocurrency associated with Helium). How Does Helium Mining Work? Helium. Helium miner HNT/IoT/Solana Token Indoor mining farm including 6 hotspots · Model NumberHT · Brand Namesolarcam · OriginMainland China. saitpro100.ru aims to make cryptocurrency mining accessible for all by offering affordable, low-power equipment for every home. We. Helium Hotspot RAK Miner V2 Mhz US/CAN HNT Token Crypto - IN HAND! SHIP ASAP. Connected to network to check if it works properly. Helium mining is energy-efficient compared to traditional cryptocurrency mining. Hotspots use minimal electricity, making it a more eco-friendly option. Helium. Helium HNT miners provide a LoRaWan and 5G network coverage to allow IoT devices to connect and top-range devices to manage between 5 dBi to dBi in terms. Helium Hotspots are devices that allow users to mine the cryptocurrency Helium (HNT). These hotspots create a wireless network by using radio waves.

Get Rid Of Collection Accounts From Credit Report

Collection or charged-off accounts: If you have a late payment and don't pay the past-due balance, the account could eventually be charged off by the. Because I am disputing this debt, you should not report it to the credit reporting agencies. If you have already reported it, please contact the credit. The correct way to do it and improve your credit score is to negotiate with the collection agency to have the account removed from ALL the. With the counselor's help, call the collections agency and arrange a payment plan so the delinquent marks roll off your credit report as quickly as possible. It. The creditor agreed to remove the collection If a creditor agrees to delete a collection, but it's still on your report, dispute immediately with written. Your credit report will take approximately two months to show that the account was paid off. The collection activity can stay on your credit report for up to 7. You can negotiate with collectors to remove unpaid collection accounts from your credit record. You can offer them a lump sum or a monthly payment plan. In. If enough time passes following a late payment, the creditor may transfer your account to a collection agency or sell your debt to a third party. In this. How to Request Pay for Delete · Your name and address · The creditor's or collection agency's name and address · The name and account number you're referencing · A. Collection or charged-off accounts: If you have a late payment and don't pay the past-due balance, the account could eventually be charged off by the. Because I am disputing this debt, you should not report it to the credit reporting agencies. If you have already reported it, please contact the credit. The correct way to do it and improve your credit score is to negotiate with the collection agency to have the account removed from ALL the. With the counselor's help, call the collections agency and arrange a payment plan so the delinquent marks roll off your credit report as quickly as possible. It. The creditor agreed to remove the collection If a creditor agrees to delete a collection, but it's still on your report, dispute immediately with written. Your credit report will take approximately two months to show that the account was paid off. The collection activity can stay on your credit report for up to 7. You can negotiate with collectors to remove unpaid collection accounts from your credit record. You can offer them a lump sum or a monthly payment plan. In. If enough time passes following a late payment, the creditor may transfer your account to a collection agency or sell your debt to a third party. In this. How to Request Pay for Delete · Your name and address · The creditor's or collection agency's name and address · The name and account number you're referencing · A.

And they have to do it for free. To correct mistakes in your report, contact the credit bureau and the business that reported the inaccurate information. Tell. If you do so, the debt collector can only contact you to confirm that it will stop contacting you and to notify you that it may file a lawsuit or take other. When the account is turned over to a collection agency, this also may be indicated on your credit report. get rid of the entire credit card debt. But. Make sure to send the dispute letter within 30 days. Once the collection company gets the letter, it must stop trying to collect the debt until it sends you. You will have to call the collections agency directly, not your apartment, and ask for a "pay for delete". Ask that since the debt will be. You can also file a dispute directly with the creditor. The Fair Credit Reporting Act (FCRA) allows you to dispute any information in your credit reports. It. Late payments can be removed from credit reports only if they were reported in error. Learn more. It's crucial to act immediately when you suspect a wrongful collection, by disputing it with both the creditor and the credit reporting agencies. Providing. Under the Federal Fair Credit Reporting Act, you have the right to dispute wrong information on your credit report. Follow this checklist: □ Write to the. The credit bureaus must reinvestigate the dispute or remove the negative information about the old debt from your credit reports. Talk to a Lawyer. If, after. The only way to have an item removed from your credit report is to have the legal owner of the debt request it's removal, or to dispute the. A new collection account may show up on your credit reports. First, you'll have 30 days to dispute the validity of the debt if you disagree with it. Your. If a paid collection on your credit reports is accurate, you can still get it removed early. One method is to ask the current creditor —the original creditor. You can remove outdated or inaccurate collections items from your credit reports either by yourself or with the assistance of a reputable credit repair company. If you have a debt settlement noted on your credit report, you might wonder if you can remove that entry. Unfortunately, the answer is no in most cases. If the charged-off account belongs to you and all the information being reported about it is accurate, you could try negotiating with the creditor or debt. If a debt collector threatens to take your home or garnish your wages, you may be the victim of a debt collection scam. File a complaint with us immediately. collection contractors, (4) credit bureau reporting, (5). Revised March the agency must report the debt after all collection efforts have been. The goal of a pay for delete arrangement is to get a collection agency to remove a collection account entirely from your credit report before the Fair Credit. Prepare a dispute letter to mail to Experian, Equifax & TransUnion requesting the fraudulent account(s) be removed from your credit reports. A sample letter can.

How To Study Candlestick

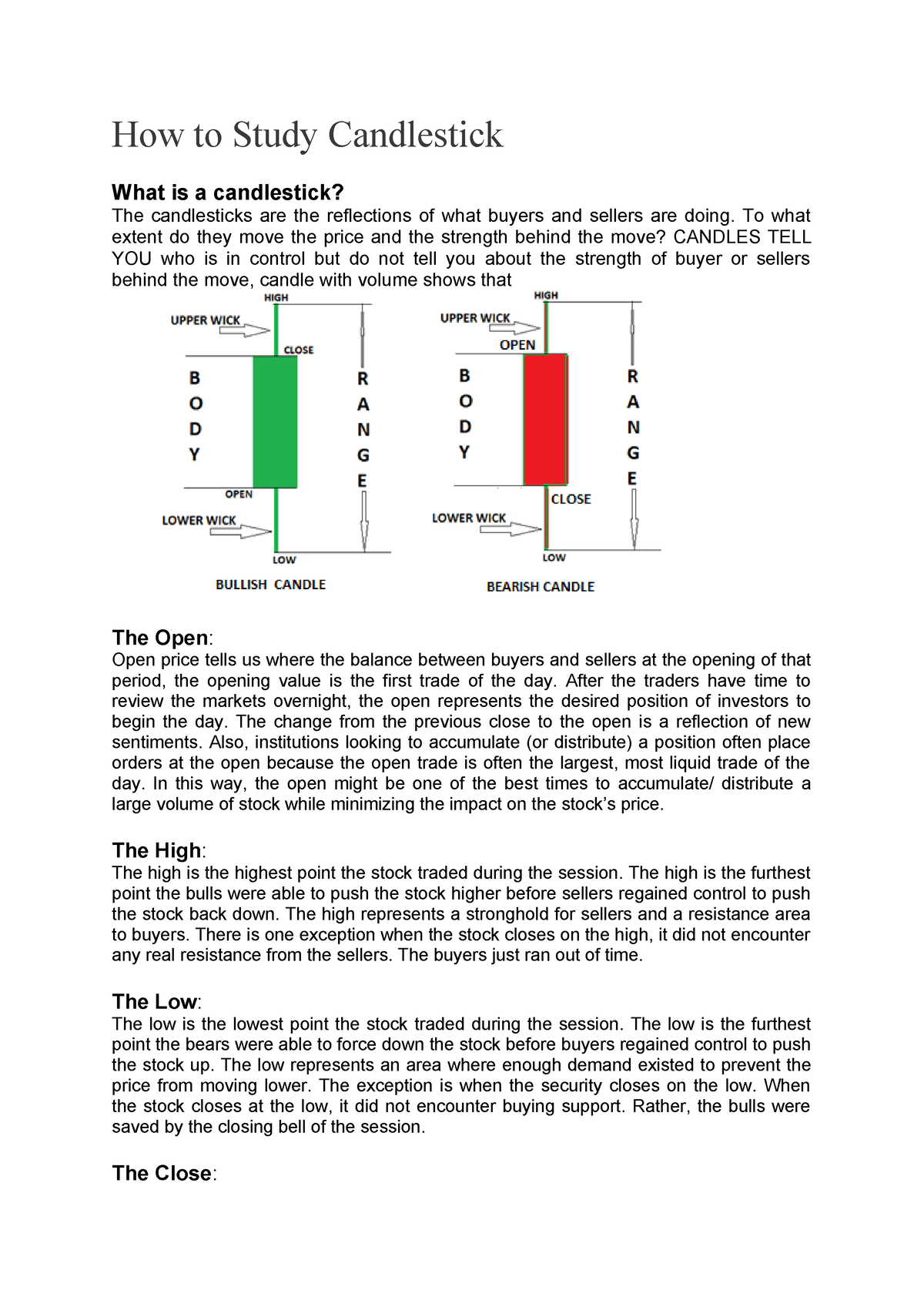

Candlestick analysis has been around for centuries and works for the same reason as other forms of technical analysis: because traders follow it. Candlesticks. A candlestick pattern refers to the shape of a single candlestick in trading. So if you're trading the one-hour time frame, any pattern that forms is the result. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. You can develop your skills in a risk-. A candlestick chart can be drawn with any data interval (except 1-tick bars). You are also able to apply any study to a candlestick chart that you can apply to. Learn how to read a candlestick chart and spot candlestick patterns that aid in analyzing price direction, previous price movements, and trader sentiments. In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to. Candlesticks give you an instant snapshot of whether a market's price movement was positive or negative, and to what degree. Here you will learn how to identify and interpret candlestick patterns the way the Japanese rice traders used them more than years ago. When you read a candlestick chart, you can determine if a session is bullish or bearish based on the opening and closing prices of the candlesticks. When the. Candlestick analysis has been around for centuries and works for the same reason as other forms of technical analysis: because traders follow it. Candlesticks. A candlestick pattern refers to the shape of a single candlestick in trading. So if you're trading the one-hour time frame, any pattern that forms is the result. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. You can develop your skills in a risk-. A candlestick chart can be drawn with any data interval (except 1-tick bars). You are also able to apply any study to a candlestick chart that you can apply to. Learn how to read a candlestick chart and spot candlestick patterns that aid in analyzing price direction, previous price movements, and trader sentiments. In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to. Candlesticks give you an instant snapshot of whether a market's price movement was positive or negative, and to what degree. Here you will learn how to identify and interpret candlestick patterns the way the Japanese rice traders used them more than years ago. When you read a candlestick chart, you can determine if a session is bullish or bearish based on the opening and closing prices of the candlesticks. When the.

All concepts of price action and candlestick trading are based on this first principle. Context means that you ALWAYS compare the current candlestick to the. To improve trading accuracy combine with volatility, volume, support/resistance and trendlines. See: How to Trade Candlestick Chart Patterns. Jack Schwager, in. A candlestick pattern refers to the shape of a single candlestick in trading. So if you're trading the one-hour time frame, any pattern that forms is the result. A group of candlesticks together form critical patterns that traders use to make trading decisions. Simple candlestick patterns can involve one or two candles. The candlesticks are the reflections of what buyers and sellers are doing. To what extent do they move the price and the strength behind the move? Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. Candlestick charts are used to display market data in a simple and compelling way to traders. This is done by representing various sizes and directions of. In order to read a candlestick chart, figure out what each different part of a candlestick tells you then study the different shapes to learn about market. Candlestick patterns are tools used in technical analysis to interpret price movements in financial markets. They are derived from Japanese candlestick charts. This software is your Nison candlestick trading coach. This gives the Nison Candlestick trader the ability to feel confident from day one no matter how much. Candlestick patterns are a powerful tool used by stock & crypto traders to predict the direction of the stock market, candlestick patterns can show the. The ultimate guide you will ever need to understand CANDLESTICK and its behaviors. After the study, you will not need to recognize any CANDLESTICK patterns. Candlestick patterns are a financial technical analysis tool that depicts daily price movement information that is shown graphically on a candlestick chart. The candlesticks are used to identify trading patterns. Patterns, in turn, help the technical analyst to set up a trade. Note that you can hide candlestick patterns directly from the Charts area by right-clicking the pattern and selecting Hide study Plots. Customize the. Candlesticks show the open, close, low, and high price of a market. They can be very useful to traders – find out how to trade using candlestick charts. Reading candlestick charts is an effective way to study the emotions of other traders and to interpret price. Candlestick charts are one of the most popular types of financial charts and tools to learn how to perform technical analysis. The candlestick chart has a rich. Candlestick charts are regularly used by investors and traders in order to identify changes within the market across stock prices. In trading, candlestick. Discover how to read Japanese Candlestick Patterns like a pro even if you have no trading experience.

Debts Not Discharged By Bankruptcy

:max_bytes(150000):strip_icc()/what-debt-cannot-be-discharged-when-filing-bankruptcy.asp_final-1787b61755b34e1799fdde71e9b8508f.png)

The most common of these debts are child support, spousal support, criminal restitution and criminal fines. Other debts may or may not be discharged, depending. Typical debts that are dischargeable include: Medical bills; Credit cards; Auto loan deficiencies; Personal loans and; Personal guarantees of business debt. Perhaps the most common debts that cannot be discharged under any circumstances are child support, back taxes, and alimony. Bankruptcy will discharge most unsecured debt. Bankruptcy is particularly good at dealing with unsecured debt, which is debt that is not secured by a lien on. Dischargeable debts are those that you could eliminate through the process. Non-dischargeable debts are those that can survive the bankruptcy discharge. A nondischargeable debt, by definition, is simply not discharged whether it was listed or not. For example, a student loan or criminal restitution debt – listed. What Debts Are Not Discharged in Bankruptcy? · domestic support obligations · student loans · most taxes · some unlisted or improperly listed debts · any debt. Dischargeable debt is debt that can be eliminated after a person files for bankruptcy. The debtor will no longer be personally liable for the debts. No one can make you pay a debt that has been discharged, but you can voluntarily pay any debt you wish to pay. You do not have to sign a reaffirmation agreement. The most common of these debts are child support, spousal support, criminal restitution and criminal fines. Other debts may or may not be discharged, depending. Typical debts that are dischargeable include: Medical bills; Credit cards; Auto loan deficiencies; Personal loans and; Personal guarantees of business debt. Perhaps the most common debts that cannot be discharged under any circumstances are child support, back taxes, and alimony. Bankruptcy will discharge most unsecured debt. Bankruptcy is particularly good at dealing with unsecured debt, which is debt that is not secured by a lien on. Dischargeable debts are those that you could eliminate through the process. Non-dischargeable debts are those that can survive the bankruptcy discharge. A nondischargeable debt, by definition, is simply not discharged whether it was listed or not. For example, a student loan or criminal restitution debt – listed. What Debts Are Not Discharged in Bankruptcy? · domestic support obligations · student loans · most taxes · some unlisted or improperly listed debts · any debt. Dischargeable debt is debt that can be eliminated after a person files for bankruptcy. The debtor will no longer be personally liable for the debts. No one can make you pay a debt that has been discharged, but you can voluntarily pay any debt you wish to pay. You do not have to sign a reaffirmation agreement.

Bankruptcy allows you to eliminate credit card debt, medical bills, repossessions and personal loans but there are certain debts that the bankruptcy code. Collectors cannot collect on the debts that have been discharged. This means that creditors have to stop all legal action, telephone calls, letters, and other. Debts that were incurred because you made a false representation or committed fraud in order to obtain the loan. · A debt incurred because of theft or. What Debts Cannot Be Discharged in Bankruptcy? · Certain types of tax debt, such as recent income tax debts or federal tax liens · Court-ordered child support and. This section specifies which of the debtor's debts are not discharged in a bankruptcy case, and certain procedures for effectuating the section. If the. According to section (a)(3) of the Bankruptcy Code, one kind of debt that's not dischargeable is a debt that you didn't list in your bankruptcy papers in. The most common of the above non-dischargeable debts are child support/maintenance, student loans and tax debts. Those debts can not be discharged as part. Bankruptcy allows you to eliminate credit card debt, medical bills, repossessions and personal loans but there are certain debts that the bankruptcy code. The Bankruptcy Code contains a small list of financial obligations that cannot always be discharged or have limitations on discharge. A discharge in bankruptcy means that you are no longer personally liable for certain debts and prevents your creditors from trying to collect on those debts. There are three categories of debts that won't be discharged in your bankruptcy case. Some debts are never discharged; some are not discharged unless you can. For instance, Chapter 7 bankruptcy covers or "discharges" credit card balances, medical bills, past-due rent payments, payday loans, overdue cellphone and. What Debts Are Not Discharged in Bankruptcy? · Spousal or child support payments · Alimony · A debt arising out of fraud · Any court-imposed fines and penalties. Discharged debts are those that you are no longer legally required to pay back. A core goal of the many bankruptcy cases our lawyers handle is to discharge as. Debts Not Dischargeable If a Creditor Objects · Credit card purchases for luxury goods. · Cash advances. · Debts obtained by fraud or false pretenses. · Debts. Collectors cannot collect on the debts that have been discharged. This means that creditors have to stop all legal action, telephone calls, letters, and other. California Non-Dischargeable Debts · Back child support, alimony obligations and other debts dedicated to family support. · Debts for personal injury or death. Which Debts are Not Discharged with Chapter 13 · Spousal support · Child support · Fines and penalties owed to government agencies · Debts owed on crimes or. For public policy reasons, several types of debts are excluded from discharge in bankruptcy. The most common debts which cannot be discharged are child support. It is important to know that certain types of debt cannot be discharged and must be repaid in a Colorado Chapter 7 Bankruptcy. Our Boulder attorneys can.

Is Refinancing A Car Loan Bad

Refinancing a car involves taking out a new auto loan and using it to pay off your existing loan. You might refinance your car to obtain a better interest rate. The rate you are paying on a loan may be directly related to the credit score you had at the time you applied for your loan. If you had bad credit, or just less. One of the greatest risks of refinancing a car loan is the possibility of ending up underwater in the loan. By refinancing, you may extend the life of the loan. Rates as of Aug 25, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. Your current loan might have a higher rate than you like, or a lot of extra costs you didn't know you agreed to. Maybe your credit score has improved and you'll. If you have low or no credit you may wish to consider taking advantage of the opportunity to refinance a vehicle. In many cases, those with less ideal. Refinancing a vehicle necessitates careful study. And balancing several variables, such as monthly budget, cash flow, reliability, interest rates, warranty. Here's how auto refinancing scams work: In reality, scam refinancers aren't negotiating with your lender or anyone else. If you make your monthly car payments. Reduce Interest Rates: From a financial planning perspective, lowering interest rates should be the number one reason to refinance car loan rates, it just doesn. Refinancing a car involves taking out a new auto loan and using it to pay off your existing loan. You might refinance your car to obtain a better interest rate. The rate you are paying on a loan may be directly related to the credit score you had at the time you applied for your loan. If you had bad credit, or just less. One of the greatest risks of refinancing a car loan is the possibility of ending up underwater in the loan. By refinancing, you may extend the life of the loan. Rates as of Aug 25, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. Your current loan might have a higher rate than you like, or a lot of extra costs you didn't know you agreed to. Maybe your credit score has improved and you'll. If you have low or no credit you may wish to consider taking advantage of the opportunity to refinance a vehicle. In many cases, those with less ideal. Refinancing a vehicle necessitates careful study. And balancing several variables, such as monthly budget, cash flow, reliability, interest rates, warranty. Here's how auto refinancing scams work: In reality, scam refinancers aren't negotiating with your lender or anyone else. If you make your monthly car payments. Reduce Interest Rates: From a financial planning perspective, lowering interest rates should be the number one reason to refinance car loan rates, it just doesn.

When might refinancing a car loan be a bad idea? · New interest rate is higher. · You plan on making other big purchases. · You'll get a longer loan term. · There's. Cars depreciate quickly. Therefore, a lender may not consider refinancing your auto loan if it's a certain age or has too many miles on it because it no longer. For all the potential positives of an auto refinancing, there could be some drawbacks. If the new loan pushes your payoff date further into the future, you. 2. What factors could make it difficult to refinance an auto loan? · If your credit score has declined, you may not be able to lower your rate · If your vehicle. Refinancing a car loan can lower your credit score temporarily, but it may result in an improved credit score over time if you make payments on time. A lender. An auto or car loan can be refinanced like most other types of loans, and you can come away from it with a lower interest rate or an extended loan term – both. When you're unable to qualify for refinancing due to bad credit, you're not out of options. If you've kept up with your payments and improved your credit, you. If interest rates have increased or your credit score has fallen since you took out your original loan, refinancing your car loan may mean you'll wind up paying. If your monthly payment is too high, refinancing your auto can help. A lower interest rate can decrease your monthly payment, but it may not be enough to make. Auto refinancing pros · Lower interest rates: This is one of the main reasons people switch car loans. · Lower monthly payments: Your lender may allow you to. A lower interest rate can help you save money on the cost of the loan over time. If you previously had bad credit or even no credit and your credit has since. If you don't have the best credit, you may be wondering if that will impact your ability to refinance your auto loan. The good news is that your credit score is. Refinancing a car loan can prove to be a worthy financial decision, but be careful that it doesn't cost you in the long run. Your Credit Score Has Improved: If your current loan is a bad credit auto loan and you have improved your credit score so you're now in 'good' territory, that. When you refinance your auto loan into a new loan with a lower interest rate, you'll enjoy lower monthly payments (and most importantly, possibly save money. The goal of refinancing is to get a new auto loan with a lower interest rate. · Your credit score will impact your rate; higher scores earn lower rates. Getting an auto refinance is still possible with a bad or low credit score, but you may not be offered the best interest rates. Knowing what lenders are looking. When might refinancing a car loan be a bad idea? · New interest rate is higher. · You plan on making other big purchases. · You'll get a longer loan term. · There's. However, once you refinance your car loan, the credit score will be affected but it will fall back to normal within a year. How much will my score go down if I. Car Loan Refinancing. Lower Payments Lower Interest Rates Defer Payments for You can even get up to $30, cash back with low interest rates when you.