saitpro100.ru

Prices

Sbltx Fund Fact Sheet

Find the latest Western Asset Intermediate-Term Muni A (SBLTX) stock quote, history, news and other vital information to help you with your stock trading. Find latest pricing, performance, portfolio and fund documents for Western Asset Intermediate-Term Municipals Fund - SBLTX Fund Fact Sheets · Order History. The fund normally invests at least 80% of its assets in "municipal securities." Municipal securities are securities and other investments with similar economic. The fund has returned percent over the past year, percent over the past three years, percent over the past five years, and percent over the. SBLTX. Growth of a Hypothetical $10, Investment as of 08/31/ This fund has multiple managers, view SBLTX quote page for complete information. 10, FUND| AHMAX|AIM TXEX| AITFX|AIM TXEX| AMCTX|AIM TXEX| SBLTX|SM BARNEY MUNI| SBLCX|SM BARNEY MUNI| SBBNX|SM BARNEY. Analyze the Fund Western Asset Intermediate-Term Municipals Fund Class A having Symbol SBLTX for type mutual-funds and perform research on other mutual. The fund may be required to liquidate portfolio securities at a time when it would be disadvantageous to do so in order to make payments with respect to any. You can find the fund's Prospectus and other information about the fund, including the fund's statement of additional information and shareholder reports. Find the latest Western Asset Intermediate-Term Muni A (SBLTX) stock quote, history, news and other vital information to help you with your stock trading. Find latest pricing, performance, portfolio and fund documents for Western Asset Intermediate-Term Municipals Fund - SBLTX Fund Fact Sheets · Order History. The fund normally invests at least 80% of its assets in "municipal securities." Municipal securities are securities and other investments with similar economic. The fund has returned percent over the past year, percent over the past three years, percent over the past five years, and percent over the. SBLTX. Growth of a Hypothetical $10, Investment as of 08/31/ This fund has multiple managers, view SBLTX quote page for complete information. 10, FUND| AHMAX|AIM TXEX| AITFX|AIM TXEX| AMCTX|AIM TXEX| SBLTX|SM BARNEY MUNI| SBLCX|SM BARNEY MUNI| SBBNX|SM BARNEY. Analyze the Fund Western Asset Intermediate-Term Municipals Fund Class A having Symbol SBLTX for type mutual-funds and perform research on other mutual. The fund may be required to liquidate portfolio securities at a time when it would be disadvantageous to do so in order to make payments with respect to any. You can find the fund's Prospectus and other information about the fund, including the fund's statement of additional information and shareholder reports.

saitpro100.ru WESTERN ASSET INTERMEDIATE-TERM MUNICIPALS FUND AMERICAFIRST LARGE CAP SHARE BUYBACK FUND AMERICAFIRST LARGE CAP SHARE BUYBACK FUND CLASS U. Under normal circumstances, the fund will invest at least 80% of its net assets, plus borrowings for investment purposes, if any, in equity securities or. Find latest pricing, performance, portfolio and fund documents for Western Asset Intermediate-Term Municipals Fund - SBLTX. Western Asset Intermediate-Term Muni A SBLTX ; NAV / 1-Day Return / + % ; Total Assets Bil ; Expense Ratio % ; Distribution Fee Level Low ; Share. SBLTX. Growth of a Hypothetical $10, Investment as of 07/31/ This fund has multiple managers, view SBLTX quote page for complete information. 11, Analyze the Fund Western Asset Intermediate-Term Municipals Fund Class A having Symbol SBLTX for type mutual-funds and perform research on other mutual. Vanguard FTSE All-World ex-US Small-Cap Index Fund ETF Shares. +%. CNDRX SBLTX. $ Western Asset Intermediate-Term Municipals Fund A. FRANKLIN BALANCE SHEET FUND CLASS A. FRBSX. Institutional Fund SBLTX. Institutional Fund. LEGG MASON FUNDS. WESTERN ASSET MANAGED MUNICIPALS. FRANKLIN BALANCE SHEET INVESTMENT A. FRC. FIRST REP BK SAN FRAN CALI NEW T ROWE PRICE FINANCIAL SERVICES FUND INV. PRITX. T ROWE PRICE INTERNATIONAL. Performance charts for Western Asset Intermediate-Term Municipals Fund (SBLTX) including intraday, historical and comparison charts, technical analysis and. Fund Strategy. The investment seeks to provide as high a level of income exempt from regular federal income tax as is consistent with prudent investing. SBLTX Fund, USD %. Western Asset Intermediate Term fundamentals sheet account changes, the income statement patterns, and various. Domicile, United States ; Symbol, SBLTX ; Manager & start date. David Fare. 31 Dec Robert Amodeo. 31 May John Mooney. 31 Mar Michael Buchanan. Sheet Investment Fd Class B, FBSBX. Franklin Balance Sheet Investment Fd Class SBLTX. Legg Mason Partners Intermediate Term Municipals, SMLLX. Legg. The Fund seeks as high a level of income exempt from federal income taxes as is consistent with prudent investing by investing at least 80% of its assets in a. SHEET FUND CLASS A. ' FRBSX. Institutional fund. FRANKLIN TEMPLETON SBLTX. Institutional fund. LEGG MASON FUNDS. WESTERN ASSET INTERMEDIATE-TERM. 31, Fund facts as of Mar. 31, access to this specialized SBLTX L | SBTYX L more or less than the original cast Class A. The fund may invest in securities of any maturity. The fund normally expects to maintain an average effective portfolio maturity of between three and ten years. Page 1. Fund Family. Fund Description. Market Type. CUSIP. NASDAQ. FUNDS SBLTX. LEGG MASON. WESTERN ASSET NJ MUNI FD CL A. BOND. M SHNJX. LEGG. ZEPP Balance Sheet. Total Cash (MRQ) American Funds The Income Fund of America® Class R-2E. %. LEXNX. $ Voya GNMA Income Fund Class A. %. SBLTX.

What Is The Best Bank Account For A Teenager

SafeBalance Banking is a smart choice for students and young adults with no monthly maintenance fee for SafeBalance Banking accounts with an owner under Open a bank account for your child today Help your child build good money habits while you keep an eye on their spending. Chase First Banking is a banking account for kids opened by parents that helps families digitally manage spending and provides opportunities for kids to learn. A checking account keeps their money safer. As your teen becomes more independent, they will likely be needing access to money without a parent or guardian with. What you need to open a checking account for a teenager · Full name, date of birth and Social Security number or ITIN · Email address and phone number · Photo ID. Teens and Money: Checking and Savings Account One of the first steps toward real freedom (and adulthood) is having checking and savings accounts in your own. The Alliant Credit Union Kids Savings Account takes the top ranking as the best overall savings account for kids. Those aged 12 and under can earn a % APY. Teens often express their desire to “grow up” quicker, and in opening a personal checking or savings account, they're entrusted to keep tabs on their own funds. A good teen checking account can help young savers learn how to effectively manage their money over the long-haul. SafeBalance Banking is a smart choice for students and young adults with no monthly maintenance fee for SafeBalance Banking accounts with an owner under Open a bank account for your child today Help your child build good money habits while you keep an eye on their spending. Chase First Banking is a banking account for kids opened by parents that helps families digitally manage spending and provides opportunities for kids to learn. A checking account keeps their money safer. As your teen becomes more independent, they will likely be needing access to money without a parent or guardian with. What you need to open a checking account for a teenager · Full name, date of birth and Social Security number or ITIN · Email address and phone number · Photo ID. Teens and Money: Checking and Savings Account One of the first steps toward real freedom (and adulthood) is having checking and savings accounts in your own. The Alliant Credit Union Kids Savings Account takes the top ranking as the best overall savings account for kids. Those aged 12 and under can earn a % APY. Teens often express their desire to “grow up” quicker, and in opening a personal checking or savings account, they're entrusted to keep tabs on their own funds. A good teen checking account can help young savers learn how to effectively manage their money over the long-haul.

Capital One's Kids Savings Account is our winner for the all-around best youth savings account.

Whether your teenager landed their first job, is looking to save for college or a first car, a checking account is a great tool to help teach them financial. Whether your teenager landed their first job, is looking to save for college or a first car, a checking account is a great tool to help teach them financial. A safe way for teens to experience money management with no fees along the way. Volt Teen Banking is a bundled checking & saving account for ages Arizona Financial's Teen Savings Account is the perfect tool to encourage your teen (ages 13 - 17) to save. Easily transfer funds between accounts and monitor. I opened Capital One teen accounts for both my kids. Capital One's app is easy to use and intuitive. My 12 yr old was able to handle hers. They. To open a free student checking account for children 12 and younger, you must first open a Galaxy Savings account for them. The Galaxy Savings account. For young adults who are stepping into the real world, the Teen Checking account is customized specifically for ages years. This special account will. However, if your teen opens an account from a local credit union or bank and keeps it in good standing, it can be used by lenders in the future to confirm that. A Mountain America teen savings account is a great way for your kids to learn to manage their money and grow their savings. A teen checking account at BECU offers the robust online and mobile banking features they crave, as well as the money management tools they'll need. A teen checking account — also referred to as a student checking account — is a joint account, with you and your teenager as co-owners. Your teenager is the. MONEY Teen Checking account A fee-free bank account for teens with a debit card and a top-rated mobile app. Birthday gifts, allowance, babysitting money—. A better bank account for teens · No unexpected fees. Wave goodbye to monthly service and minimum balance fees, and say hello to 80,+ fee-free ATMs and $20/. Youth accounts are designed for teens between the ages of 14 and 2 Forms of ID*. A student's Wisconsin ID, Driver's License, school ID or current pay stub. A Grow Strong Checking Account is a great way for teens to learn financial responsibility and manage their money with an ATM card or debit card. Can a teenager open a checking account? Banks in many states require parental involvement in a teen's checking account, which is the best safeguard against. Keep in mind that if you're under the age of 18, you must apply for a checking account in-person with a co-signer or joint account holder that is over the age. Most providers offer bank accounts to children between the ages of 11 and They are generally similar to adult ones; you can pay money in and make. The best teen checking account for you will offer low fees, a robust set of management tools, parental controls, and access to cash at ATMs that are convenient. Work with your current bank or credit union to identify the right type of bank account for your teen. You may choose to open a joint standard checking account.

Who Pays The Best Interest Rates On Savings

:max_bytes(150000):strip_icc()/savings_account_rates_ap060525015560-5bfc36a446e0fb0051474f94.jpg)

The American Express® High Yield Savings Account* was ranked best overall for its above-average Annual Percentage Yield (APY), ease-of-use and 24/7 customer. best interest rates I can find.” MF, Chicago, IL. “Evergreen Bank has been an amazing partner in the expansion of our family run business. Their commercial. The BrioDirect High-Yield Savings Account earns one of the highest rates on the market at % APY and comes with no monthly fee. The downside is that you'll. Interest Rates and APYs for all checking and savings accounts are variable and can be changed by the Bank at any time. Fees could reduce earnings. The balance. Best High-Yield Savings Account Rates for August · Poppy Bank – % APY · Flagstar Bank – % APY · Western Alliance Bank – % APY · Forbright Bank –. Savings and interest checking account rates are based on the $2, product tier, while money market and certificate of deposit rates represent an average of. Our picks for the best high-yield savings accounts are SoFi (%), Bask Bank (%), and Discover (%), but you can get rates as high as % from. Why a high-yield savings account is always a good idea · Best overall: LendingClub High-Yield Savings · Best for earning high APY: UFB Preferred Savings . Open a Quontic High-Yield Savings Account in just 3 minutes with an APY of %*. Start earning from day 1 of your first deposit with no limit on how much you. The American Express® High Yield Savings Account* was ranked best overall for its above-average Annual Percentage Yield (APY), ease-of-use and 24/7 customer. best interest rates I can find.” MF, Chicago, IL. “Evergreen Bank has been an amazing partner in the expansion of our family run business. Their commercial. The BrioDirect High-Yield Savings Account earns one of the highest rates on the market at % APY and comes with no monthly fee. The downside is that you'll. Interest Rates and APYs for all checking and savings accounts are variable and can be changed by the Bank at any time. Fees could reduce earnings. The balance. Best High-Yield Savings Account Rates for August · Poppy Bank – % APY · Flagstar Bank – % APY · Western Alliance Bank – % APY · Forbright Bank –. Savings and interest checking account rates are based on the $2, product tier, while money market and certificate of deposit rates represent an average of. Our picks for the best high-yield savings accounts are SoFi (%), Bask Bank (%), and Discover (%), but you can get rates as high as % from. Why a high-yield savings account is always a good idea · Best overall: LendingClub High-Yield Savings · Best for earning high APY: UFB Preferred Savings . Open a Quontic High-Yield Savings Account in just 3 minutes with an APY of %*. Start earning from day 1 of your first deposit with no limit on how much you.

But how can banks afford to pay interest on their customers' savings account deposits if they're loaning out money? Generally, savings account rates are lower. This Account pays interest at a variable interest rate and rates may vary based on the balance in your Account. We may change the interest rate and APY at our. pay a lower tax rate for than you paid last year. So, for example, let's say that you earned $10, in interest income and your marginal tax rate is. Money market accounts require higher balances, typically offer higher interest rates, and provide the flexibility of writing checks to access your funds. Meet. Top Savings Account Interest Rates · SoFi Checking and Savings · Capital One - Performance Savings · Bask Interest Savings Account · CIT Bank - Platinum Savings. Bankrate provides you with timely news and rate information on the top savings yields from some of the most popular and largest Federal Deposit Insurance Corp. But how can banks afford to pay interest on their customers' savings account deposits if they're loaning out money? Generally, savings account rates are lower. Banks with high-yield savings accounts' interest rates ; UFB Direct, %, $0 ; Upgrade, %*, $0 ; Varo Bank, %, $0 ; Western Alliance, %, $0. You get a say in how we're run; When we make money, so do you - the money we earn is given back to you in interest rates or goes towards paying for the. Best of the big four: ANZ, CBA, NAB and Westpac ; Progress Saver – % · Online Saver – % ; GoalSaver – % · NetBank Saver – % ; Reward Saver – %. They offer higher interest rates than traditional fixed or easy-access savings accounts, but tend to impose rigid terms and conditions, such as limiting the. People with cash to deposit consider the interest rates on savings accounts as they compare to the rates they can find on other savings destinations, such as. While regular savings accounts can pay higher rates of interest, the problem with them is that it takes time to build up the amount of money you have in there. pay a lower tax rate for than you paid last year. So, for example, let's say that you earned $10, in interest income and your marginal tax rate is. Money market accounts require higher balances, typically offer higher interest rates, and provide the flexibility of writing checks to access your funds. Meet. The best place for most people is a money market fund because (a) they have higher yield than nearly all savings accounts and (b) they have. Be looking for better interest rates on your nest egg; Want to open your child's first savings account; Have spare cash and looking to save for a longer term. This Account pays interest at a variable interest rate and rates may vary based on the balance in your Account. We may change the interest rate and APY at our. Interest Rates and APYs for all checking and savings accounts are variable and can be changed by the Bank at any time. Fees could reduce earnings. The balance. savings with tiered interest rates that may pay more for higher balances. In comparison, CDs offer a greater return on your savings with higher fixed.

Carry On Luggage For Airlines

A standard carry-on bag measures 55 cm ( in) in height, 23 cm (9 in) in depth, and 40 cm ( in) in width, while a personal item adheres to the. As a general guide, carry-on baggage should have maximum length of 22 in (56 cm), width of 18 in (45 cm) and depth of 10 in (25 cm). For United Airlines Foldable Carry on Bag 22x14x9 Travel Duffel Bag Packable luggage Duffle for Women and Men 40L (Grey (With Shoulder Strap)). Cabin bags, also called hand luggage or carry-on bags, are usually limited to around 10kg for economy airline passengers. It's always worth checking the. Airlines generally permit passengers to take free items of carry-on luggage onto a flight. One of these is traditionally a 'personal' item, which must be. Our smallest suitcase that fits in the overhead bin of most airlines. In case of extended stays or extra souvenirs. Our best selling carry-on that fits in. Standard, domestic, carry-on luggage size is currently limited to around 22 inches tall, 9 inches deep, and 14 inches wide. No, a 22 inch carry-on bag is not too big, since it's a standard size for most airlines. But we always advise to double check the size allowance before your. You may bring one carryon bag and one personal item without charge (subject to the limitations below). The bag should be stowed in the overhead compartment. A standard carry-on bag measures 55 cm ( in) in height, 23 cm (9 in) in depth, and 40 cm ( in) in width, while a personal item adheres to the. As a general guide, carry-on baggage should have maximum length of 22 in (56 cm), width of 18 in (45 cm) and depth of 10 in (25 cm). For United Airlines Foldable Carry on Bag 22x14x9 Travel Duffel Bag Packable luggage Duffle for Women and Men 40L (Grey (With Shoulder Strap)). Cabin bags, also called hand luggage or carry-on bags, are usually limited to around 10kg for economy airline passengers. It's always worth checking the. Airlines generally permit passengers to take free items of carry-on luggage onto a flight. One of these is traditionally a 'personal' item, which must be. Our smallest suitcase that fits in the overhead bin of most airlines. In case of extended stays or extra souvenirs. Our best selling carry-on that fits in. Standard, domestic, carry-on luggage size is currently limited to around 22 inches tall, 9 inches deep, and 14 inches wide. No, a 22 inch carry-on bag is not too big, since it's a standard size for most airlines. But we always advise to double check the size allowance before your. You may bring one carryon bag and one personal item without charge (subject to the limitations below). The bag should be stowed in the overhead compartment.

Well-made, durable Travelpro carry-on luggage is designed with airline carry-on luggage size restrictions in mind and boasts features like USB A & C ports and. As a general guide, carry-on baggage should have maximum length of 22 in (56 cm), width of 18 in (45 cm) and depth of 10 in (25 cm). Before checking in, please check the quantities of allowed carry-on baggage and checked baggage and the related baggage regulations. You are allowed to bring a quart-sized bag of liquids, aerosols, gels, creams and pastes in your carry-on bag and through the checkpoint. All carry-on items must meet Federal Aviation Administration (FAA) regulations and may not exceed 22" x 14" x 9". The FAA mandates that all carry-on items fit. We have created a comprehensive luggage sizing chart to help you make the perfect choice for your next adventure. Carry-on bags Your bag must fit in the overhead bin, so it must be 9 in x 14 in x 22 in (23 cm x 35 cm x 56 cm). When measuring include the handle and wheels. There is a 7kg limit per passenger for carry-on baggage, which must be stored in the overhead locker on Aer Lingus Regional flights (operated by Emerald. For instance, many airlines have maximum dimensions and weights for hand luggage, and you are not allowed to carry more than one piece of hand luggage. It is. Carry-on bag size. The carry-on bag size limit for flights on all aircraft types is to 22'' x 14'' x 9'' - these dimensions include the wheels and handles. Be. Carry-on bags Your bag must fit in the overhead bin, so it must be 9 in x 14 in x 22 in (23 cm x 35 cm x 56 cm). When measuring include the handle and wheels. Hand luggage on airlines is typically required to not exceed 7 kilograms and overall dimensions of length, breadth, and height must not exceed cm, according. There is a 7kg limit per passenger for carry-on baggage, which must be stored in the overhead locker on Aer Lingus Regional flights (operated by Emerald. Active duty military passengers, subject to verification, may bring one carry-on bag and/or may check up to two bags, which may be oversized and/or overweight. A common sized bag for carry-on luggage is 22"x 14"x 9". Most airlines have a carry-on weight limit of 40 pounds. International airlines may have different. Samsonite Freeform Hardside Expandable with Double Spinner Wheels, Carry-On Inch, · Travelers Club Chicago Hardside Expandable Spinner Luggage, Charcoal, 20". A superior carry-on handle. We focused on rethinking the critically important but often neglected telescopic handle, custom-designing every part from the. A carry-on bag is a luggage that airplane passengers can take and store with them during the flight. Checked-in luggage is baggage stored in the cargo section. “We physically test our carry-on bags in a sizer before releasing [the design] for production,” says Scott Applebee, Travelpro's vice president of marketing.

How To Get Rid Of Bill Collectors

To stop a debt collector from calling you at home or work: · Contact your creditors to work out a payment plan. · Meet with an attorney to discuss legal options. You may stop a collector from contacting you by writing a letter to the collection agency telling them to stop. Once the agency receives your letter, they may. So, if you want to bypass a debt collector, contact your original creditor's customer service department and request a payment plan. They may be willing to. The FDCPA prohibits debt collectors from contacting you repeatedly, using profane language, making threats, or otherwise harassing you. If a debt collector is. Make sure you dispute the debt in writing within 30 days of when the debt collector first contacted you. If you do so, the debt collector must stop trying to. You can also stop the collector from contacting you during the time you dispute the debt by writing a cease collection letter. Simply write: I am disputing this. If you are being subjected to harassing, abusive, or fraudulent debt collection tactics by professional debt collectors — and you want to stop further contact. Tell them you'd like to negotiate paying off your debt. Tell them you're in a better position now but not $ better. Offer $ and go from. If you want a debt collector to stop contacting you, you can send them a letter asking them to stop contacting you. Debt collectors cannot call you if you write. To stop a debt collector from calling you at home or work: · Contact your creditors to work out a payment plan. · Meet with an attorney to discuss legal options. You may stop a collector from contacting you by writing a letter to the collection agency telling them to stop. Once the agency receives your letter, they may. So, if you want to bypass a debt collector, contact your original creditor's customer service department and request a payment plan. They may be willing to. The FDCPA prohibits debt collectors from contacting you repeatedly, using profane language, making threats, or otherwise harassing you. If a debt collector is. Make sure you dispute the debt in writing within 30 days of when the debt collector first contacted you. If you do so, the debt collector must stop trying to. You can also stop the collector from contacting you during the time you dispute the debt by writing a cease collection letter. Simply write: I am disputing this. If you are being subjected to harassing, abusive, or fraudulent debt collection tactics by professional debt collectors — and you want to stop further contact. Tell them you'd like to negotiate paying off your debt. Tell them you're in a better position now but not $ better. Offer $ and go from. If you want a debt collector to stop contacting you, you can send them a letter asking them to stop contacting you. Debt collectors cannot call you if you write.

If you want a debt collector to stop contacting you, you can send them a letter asking them to stop contacting you. Debt collectors cannot call you if you write. Under the FDCPA, you can inform the third-party debt collector that you want them to stop contacting you. The law requires them to cease contact unless they are. get a better handle on your debt. Here's when you may be able to bypass debt collectors and work with your original creditor to repay what you owe. If you have been contacted by a debt collector who has not treated you fairly or whose activities violate the Fair Debt Collection Practices Act you can file a. Your Right to Request to Cease Contact. Under the FDCPA, you can inform the third-party debt collector that you want them to stop contacting you. The law. You can try to negotiate with the collection agency to have the collection removed. You would pay a fee to the collection agency and they would stop reporting. Communicating with debt collectors can make it easier to resolve your debt. This means picking up the phone when they call, calling them first, or responding to. You can request a "goodwill deletion" from the creditor, who may be the original creditor or a debt collector. Send a letter to the debt. Remember, though, stopping the contact does not stop the debt-collection activities. The debt collector can still send negative information to the credit-. Once you dispute the debt, the debt collector must stop all debt collection activities until it sends you verification of the debt. You can also use the sample. You may stop a collector from contacting you by writing a letter to the agency telling them to stop. Once the agency receives your letter, they may not contact. To ensure that the collector receives the letter, send it via certified mail. However, if the debt belongs to you, even if a debt collector stops contacting you. To ensure that the collection agency's calls stop, you must give the collection agency written notice stating that you refuse to pay the debt, or requesting. To ensure that the collector receives the letter, send it via certified mail. However, if the debt belongs to you, even if a debt collector stops contacting you. Even if your debt is already in collections, debt collectors are not allowed to lie to you, threaten you, use obscene language or harass you by phone. However. If you have past due debts, the business you owe the money to (the creditor) may turn the debt over to a debt collector to try to collect the money. DCAs specialise in collecting debts that the original creditors could not get paid. There are many DCAs in the UK. Some are small and only deal with certain. How do I stop collection calls? You may stop a debt collector from contacting you by writing a letter to the agency telling them to stop. Once the agency. Asking them to stop contacting you will not prevent them from suing you or reporting the debt to a credit reporting company. If you do not owe the debt or have. Make all payments to the IRS. The PCA will never ask you to pay them directly or through prepaid debit, iTunes or gift cards. The private collection agency can.

Barclays Trading Platform

Barclays today announced BARX as its newly integrated, cross-asset electronic trading platform across Equities, Fixed Income, Futures, and FX. In response to the Global Financial Crisis, in , QPS launched bond-level Liquidity Cost Scores (LCS) based on quotes from Barclays trading desks and. Web Financial Group Active Trader is a paid for research service which helps you monitor fast moving markets. Read more here. Barclays PLC is a diversified bank with five divisions comprising Barclays UK, Barclays UK Corporate Bank, Barclays * Best trading platform as awarded at the. Our platform is not merely a link to Barclays Capital Inc (UK); it's an elaborate ecosystem built for prime brokers, asset managers, financial organizations. Barclays uses cookies on this website. I started working in the 'Algo Core' team, supporting the infrastructure of our equities algorithmic trading platform. Known as BARX, the new electronic trading platform will cater to equities, fixed income, futures and FX, using the bank's data science tools for trade analytics. Independent Financial Advisers (IFAs) and LV='s customers will benefit from immediate and direct access to an execution-only trading platform. This new. Learn about interest rate movements, manage FX solutions with the Barclays' network of corporate FX specialists and corporate trading platform. Barclays today announced BARX as its newly integrated, cross-asset electronic trading platform across Equities, Fixed Income, Futures, and FX. In response to the Global Financial Crisis, in , QPS launched bond-level Liquidity Cost Scores (LCS) based on quotes from Barclays trading desks and. Web Financial Group Active Trader is a paid for research service which helps you monitor fast moving markets. Read more here. Barclays PLC is a diversified bank with five divisions comprising Barclays UK, Barclays UK Corporate Bank, Barclays * Best trading platform as awarded at the. Our platform is not merely a link to Barclays Capital Inc (UK); it's an elaborate ecosystem built for prime brokers, asset managers, financial organizations. Barclays uses cookies on this website. I started working in the 'Algo Core' team, supporting the infrastructure of our equities algorithmic trading platform. Known as BARX, the new electronic trading platform will cater to equities, fixed income, futures and FX, using the bank's data science tools for trade analytics. Independent Financial Advisers (IFAs) and LV='s customers will benefit from immediate and direct access to an execution-only trading platform. This new. Learn about interest rate movements, manage FX solutions with the Barclays' network of corporate FX specialists and corporate trading platform.

Barclays also said it planned to launch a professional trader platform providing clients access to more complex financial tools and data, free to investors. Barclays's cross-asset electronic trading platform across Equities, Fixed Income, Futures, and FX. BARX is designed to optimize execution performance for. trading platforms. Barclays will pay $70 million, split evenly between the two enforcers,the largest fine levied on adark pooloperator, the SEC said Sunday. Join J.P. Morgan, ICAP, and Barclays in investing in Cloud9, the leading cloud-based voice trading platform transforming the financial industry. BARX. Leveraging the power of the entire bank. ENHANCING EXECUTION. Electronic trading with BARX. BARX is Barclays' cross-asset electronic trading platform. Barclays PLC Stock Using Trading Platform:After opening account you can trade Barclays PLC shares CFDs by using MetaTrader or NetTradeX trading platforms. Barclays is listed and traded on the London Stock Exchange under the ticker symbol BARC.L and on the New York Stock Exchange under the ticker symbol BCS. The Barclays Indices are a diverse family of systematic non-discretionary trading strategy indices available across multiple asset classes including. Former head of Asia FX options trading at Barclays Algo trading platform plans four-day fundraising drive in March for Leukemia & Lymphoma Society. At any time, Barclays may implement enhancements to its equities electronic trading platform, which includes Barclays algorithms, router, and core. Web trading platform: While online brokers are usually available on various platforms like mobile and tablet apps or desktop software, most people use them. platforms we may use to deliver personalised advertisements and messages. If Trade your shares through Equiniti at a competitive price; Benefit from. January 30 Investing in funds · Barclays customers locked out of accounts as platform woes continue ; October 6 UK banks · Barclays Smart Investor. trading platform owned by the New York Stock Exchange and available through most brokerage firms and discount trading platforms. The Return on Disability. They clearly wanted to dissolve Barclays Stockbrokers and seem perfectly and arrogantly content with the collapse of the trading platform, driving away half the. Access information about our bespoke FX and Money Markets trading channel for If you do not receive an email in the next 15 minutes, please email barclayslive. To trade Barclays stock CFDs with us, just sign up for a saitpro100.ru account, and once you're verified, you can use our advanced web platform or download our. platforms on which we advertise. They do this in order to provide you with Barclays is a trading name and trade mark of Barclays PLC and its subsidiaries. Trading is fairly priced and it's a decent option for a mixed bag of Barclays Smart Investor is an investment platform owned by Barclays, one of.

Loan From Pension Plan

When can I borrow? You must have at least three years of service credit and contributions posted to your pension account. Pension credit is "posted" to your. You can borrow money from your retirement plan and pay the funds back with lower interest rates than other types of borrowing, such as a credit card. Pension loans are legally allowed in many cases, but plan sponsors determine whether they're allowed. Employees often reduce or stop saving in their retirement savings plan after taking out a loan, which can significantly hinder their savings abilities. However. The withdrawal will be deducted proportionately from all funds in the participant's account. Loan payments are made with after-tax dollars and are applied to. Eligibility Must have three years of contributing membership posted to your account · How to Apply. Submit your loan request online using the Member Benefits. Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans. If you joined NYSLRS before January 1, You may borrow up to 75 percent of your contribution balance or $50,, whichever is less. However, your loan may. Typically, the maximum amount you can borrow from a retirement plan is 50% of your vested account balance, or $50,,3 whichever is less. “Vested" balance. When can I borrow? You must have at least three years of service credit and contributions posted to your pension account. Pension credit is "posted" to your. You can borrow money from your retirement plan and pay the funds back with lower interest rates than other types of borrowing, such as a credit card. Pension loans are legally allowed in many cases, but plan sponsors determine whether they're allowed. Employees often reduce or stop saving in their retirement savings plan after taking out a loan, which can significantly hinder their savings abilities. However. The withdrawal will be deducted proportionately from all funds in the participant's account. Loan payments are made with after-tax dollars and are applied to. Eligibility Must have three years of contributing membership posted to your account · How to Apply. Submit your loan request online using the Member Benefits. Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans. If you joined NYSLRS before January 1, You may borrow up to 75 percent of your contribution balance or $50,, whichever is less. However, your loan may. Typically, the maximum amount you can borrow from a retirement plan is 50% of your vested account balance, or $50,,3 whichever is less. “Vested" balance.

Most employer-sponsored retirement plans are allowed by the IRS to provide loans to participants, but borrowing from IRAs is prohibited. As much as you may need the money now, by taking a distribution or borrowing from your retirement funds, you're interrupting the potential for the funds in your. There is no regulatory limit on the number of loans – only the maximum dollar amount – but plans are free to impose such a limit. It may be a limit on the. Lower interest rates: (k) loans may have lower interest rates than the average borrower would be able to get on a personal loan or a credit card. · Interest. How much credit can I get? You can request up to 75% of your OAS Retirement & Pension Plan. The maximum line of credit is $65, (k) loans With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as. A plan as old as tax returns, with nearly as many failures. Have you preliminary done your taxes already? Do you "know" a return is imminent? The New Jersey Division of Pensions & Benefits. (NJDPB) allows you to borrow from your retirement system a minimum of $50, and loan amounts then increase in. A (k) loan allows you to take out a loan against your own (k) retirement account, or essentially borrow money from yourself. While you'll pay interest. The withdrawal will be deducted proportionately from all funds in the participant's account. Loan payments are made with after-tax dollars and are applied to. Yes, pension plan loans allow you to use your pension as collateral. However, borrowing from pension to pay off debt can be a risky gamble as a failure to pay. Can I take out a loan from my pension plan? No. Nor can you make early withdrawals. NEXT: Should I take a lump-sum payout or monthly payments? How much can I borrow? · The minimum loan amount is $1, or an amount specified by your retirement plan · The maximum loan amount is the lesser of 50% of the. You may borrow up to 50% of your account, but never more than $50, Your principal and interest payments are returned to your account. With one exception. Loans FAQs · Only two loans are permitted in any month period, unless prior loans have been repaid or canceled. · Loans must be at least $ · The maximum. The amount of your pension reduction will be based on your age, the loan balance at retirement and the type of retirement (service or disability). Here are. You may borrow a minimum of $1, up to a maximum of $50, or 50% of your vested account balance reduced by your highest outstanding loan balance during the. PUBLIC SCHOOL EMPLOYEES' RETIREMENT SYSTEM (PSERS). Borrowing from Your Therefore, PSERS may not provide you with a loan or allow you to borrow funds from. Loans or borrowing Due to Internal Revenue Service regulations regarding government pension plans, none of the state retirement plans (PERS, TRS, LEOFF. One of the many benefits provided by the Teachers' Retirement System of the City of New York (TRS) is the ability to borrow against your Qualified Pension Plan.

Lenders For Fair Credit

Upstart offers personal loans up to $50,, approves borrowers with credit scores as low as , and offers one of the lowest APRs on the market. Only the best. The Fair Housing Act (FHA) and Equal Credit Opportunity Act (ECOA) protect consumers by prohibiting unfair and discriminatory practices. Bankrate's expert team helps you compare fair credit loans from an array of lenders. Apply for a loan today! Many lenders are willing to make personal loans for fair credit borrowers. You may pay a little more in interest, but you'll have access to the cash you need. APRs starting at %. Personal loan interest rates typically range between 9% and 36%. The starting rates for Avant Loans are on the lower end of the spectrum. It is adapted from the Interagency Policy Statement on Fair Lending issued in. March Lending Discrimination Statutes and Regulations. The Equal Credit. Best for people without a credit history: Upstart Personal Loans · Best for debt consolidation: Happy Money · Best for flexible terms: OneMain Financial Personal. Personal loans for fair credit are available from a number of sources, but LoanNow may be the best possible choice for personal loans for fair credit. Considering buying a home with bad credit? Learn about home loans for bad credit, along with tips for improving your credit score to qualify for a mortgage. Upstart offers personal loans up to $50,, approves borrowers with credit scores as low as , and offers one of the lowest APRs on the market. Only the best. The Fair Housing Act (FHA) and Equal Credit Opportunity Act (ECOA) protect consumers by prohibiting unfair and discriminatory practices. Bankrate's expert team helps you compare fair credit loans from an array of lenders. Apply for a loan today! Many lenders are willing to make personal loans for fair credit borrowers. You may pay a little more in interest, but you'll have access to the cash you need. APRs starting at %. Personal loan interest rates typically range between 9% and 36%. The starting rates for Avant Loans are on the lower end of the spectrum. It is adapted from the Interagency Policy Statement on Fair Lending issued in. March Lending Discrimination Statutes and Regulations. The Equal Credit. Best for people without a credit history: Upstart Personal Loans · Best for debt consolidation: Happy Money · Best for flexible terms: OneMain Financial Personal. Personal loans for fair credit are available from a number of sources, but LoanNow may be the best possible choice for personal loans for fair credit. Considering buying a home with bad credit? Learn about home loans for bad credit, along with tips for improving your credit score to qualify for a mortgage.

Learn More About OppLoans To facilitate safe, simple and more affordable credit access to everyday Americans who currently lack traditional options while. A Personal Unsecured Installment Loan provides you access to the money you need without using your property as collateral. · Pay Off Credit Cards · Moving. What loans can I get with fair credit? · Marker-Numberx Personal or unsecured loan. You don't need to put down security, such as your home, to be. If you're aiming for a fair credit auto loan, this means you're able to borrow less money from a lender. Additionally, you may be eligible to select from a. Personal loans for fair credit are for borrowers with credit scores from to Compare rates and terms at online lenders offering loans up to $ Fair credit scores typically range from to , and while you'll still likely qualify for a loan, you may have a more limited selection of lenders. Many lenders are willing to make personal loans for fair credit borrowers. You may pay a little more in interest, but you'll have access to the cash you need. A fair credit score is considered below-average credit and falls between and on the FICO scale. It's a step up from bad credit. There are several kinds of loans that you may be able to obtain even with a bad credit score. Let's explore some of these loans below. Get personalized rates in 60 seconds for bad credit loans in New York, without affecting your credit score. If you have a fair credit score, limited credit background, or you've hit a few bumps along the way, Reprise can help you find the personal loan that's right. Best fair credit personal loans · Prosper: Best overall. · Avant: Best for building credit. · Achieve: Best for discounts. · LendingPoint: Best for quick approval. Some of the best lenders to consider for a $15, loan with fair credit include LightStream, American Express, SoFi and Wells Fargo. Just about any lender that. Best for Large Amounts: SoFi. SoFi logo. · Good - Exceptional · - % · 24 - 84 mo ; Best for Debt Consolidation: Happy Money. Happy Money logo. · Fair -. Looking for personal loans for fair credit? Borrowers with a fair credit score ( to ) can still get an unsecured personal loan. Request online and get. We've rounded up some of the best fair credit personal loans based on various factors, including minimum credit score requirements, loan amounts and rates. I have a fair credit Between the range and I'm trying to get a dollar personal loan to pay off each month to help with some. With an FHA loan, you will need a minimum credit score of , a % down payment, and a debt to income ratio no greater than 43%. Bear in mind that FHA loans. Personal loans are accessible to those with bad credit; traditional lenders use credit scores to determine loan decisions and rates. Atlas Credit fair credit score loans are easy to apply for and could be a good option for those with a fair credit score. You can fill out an application in-.

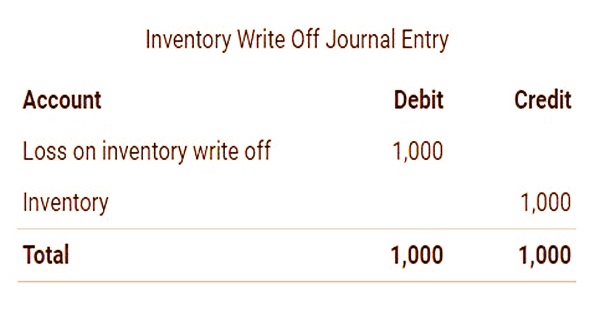

How To Write Off Inventory

The debit in the entry to write down inventory is recorded in an account such as Loss on Write-Down of Inventory, which is an income statement account. It provides guidance for determining the cost of inventories and for subsequently recognising an expense, including any write-down to net realisable value. It. An inventory write down is an accounting process used to record the reduction of an inventory's value and is required when the inventory's market value drops. Debit the "loss on inventory write-down" account in your records by the amount of the loss. If the loss is insignificant to your small business, you can debit. Record an inventory adjustment to bring the item quantities to 0. My updated answer about immediately deducting inventory is now “maybe, it depends.” Read on if you like details. Create a new inventory write-off · Navigate to Production/Inventory → New → Inventory Write Off. · Identify the Location where stock will be written off. When writing off inventory, businesses must stick to accounting principles and guidelines. The cost for the unsold items is taken off the company's balance. Three scenarios that require a business write-off include unpaid bank loans, unpaid receivables, and losses on stored inventory. A write-off reduces taxable. The debit in the entry to write down inventory is recorded in an account such as Loss on Write-Down of Inventory, which is an income statement account. It provides guidance for determining the cost of inventories and for subsequently recognising an expense, including any write-down to net realisable value. It. An inventory write down is an accounting process used to record the reduction of an inventory's value and is required when the inventory's market value drops. Debit the "loss on inventory write-down" account in your records by the amount of the loss. If the loss is insignificant to your small business, you can debit. Record an inventory adjustment to bring the item quantities to 0. My updated answer about immediately deducting inventory is now “maybe, it depends.” Read on if you like details. Create a new inventory write-off · Navigate to Production/Inventory → New → Inventory Write Off. · Identify the Location where stock will be written off. When writing off inventory, businesses must stick to accounting principles and guidelines. The cost for the unsold items is taken off the company's balance. Three scenarios that require a business write-off include unpaid bank loans, unpaid receivables, and losses on stored inventory. A write-off reduces taxable.

This article will guide you through the intricacies of writing off inventory in Quickbooks, a widely used accounting software, and explore the various methods. An inventory that can be used under the best accounting practice in a balance sheet showing the financial position of the taxpayer can, as a general. An inventory that can be used under the best accounting practice in a balance sheet showing the financial position of the taxpayer can, as a general. Writing off inventory involves removing the cost of 'no-value' inventory items from the accounting records. · Unsold inventory is an asset on your balance sheet. It is just a term used in the accounting process of decreasing the inventory value that has totally lost all of its value. WVDOT REQUEST FOR INVENTORY WRITE-OFF. FORM DOT-6a. REQUESTED BY: APPROVED: DISAPPROVED: DISTRICT COMPTROLLER. APPROVED: DISAPPROVED. How to write off inventory D Finance and operations Please verify the solutions which works for you. Hi phyllispang,. If it's the actual transaction. It takes an accounting process called an inventory write-down to record this loss in value. This inventory retains some value and is still considered sellable. Inventory write-offs refer to the process of removing the value of unsellable or obsolete inventory items from a company's financial records. Promotional samples given to customers count as inventory items. We'll show you how to adjust your inventory and move the Cost of Goods to a Promotional. An inventory write-off process lowers the worth of a company's inventory to denote that it has no value. How to Account for Inventory Write-Off · Find the current fair market value of the inventory. · Debit your "Cost of Goods Sold" account by the difference. To write the products off that simply means taking those products out of inventory and decreasing Inventory Asset on the balance sheet which then increases. Inventory is typically written down for two reasons: When they cannot sell inventory, they have to write it down. Otherwise inventory will be artificially high. There are two main steps to writing off your inventory: estimating (premeditating) the loss and calculating the actual loss. The first step of inventory write off is to inspect it. This can help you to decide which method is the best to write off the items. Tax Code & Writing Off Inventory. If your business has an inventory, its value is an important part of your taxable income. Writing off inventory that's. You can value stock at cost or market value, so stock that is worth less than cost can be marked down. The deduction appears in the cost of sales part of your. Writing off inventory involves adjusting a company's books to reflect items that can no longer be sold. Here's our simple guide to help you navigate this. To write off and report on serialized items · In OnSite StoreMaster open the product for the serialized item you want to write off and click the Inventory tab.

Stock Price Outlook

Find the latest user stock price predictions to help you with stock trading and investing. The Brent crude oil spot price ended July at $81 per barrel (b), compared with an average for the month of $85/b. We expect the Brent price will return to. Find the latest Outlook Therapeutics, Inc. (OTLK) stock quote, history, news and other vital information to help you with your stock trading and investing. Last quarter, we thought utilities and real estate were overvalued, but with the recent stock price declines, we now see these areas as roughly fairly valued. Tech stocks led the stock market lower Thursday, as Wall Street braced for Fed Chair Jerome Powell's speech on Friday morning. nyse stock market today. Stock. Get investment market updates with Bank of America Private Bank's Capital Market Outlook issue on the oil market, earnings stall, recession fears. Wall Street analysts are projecting S&P companies will continue to report steady earnings growth. They forecast a % earnings growth in the third quarter. Stock Price Forecast The 33 analysts with month price forecasts for Microsoft stock have an average target of , with a low estimate of and a high. View analyst forecasts, price targets, buy/sell ratings, revenue/earnings forecasts and more. Find the latest user stock price predictions to help you with stock trading and investing. The Brent crude oil spot price ended July at $81 per barrel (b), compared with an average for the month of $85/b. We expect the Brent price will return to. Find the latest Outlook Therapeutics, Inc. (OTLK) stock quote, history, news and other vital information to help you with your stock trading and investing. Last quarter, we thought utilities and real estate were overvalued, but with the recent stock price declines, we now see these areas as roughly fairly valued. Tech stocks led the stock market lower Thursday, as Wall Street braced for Fed Chair Jerome Powell's speech on Friday morning. nyse stock market today. Stock. Get investment market updates with Bank of America Private Bank's Capital Market Outlook issue on the oil market, earnings stall, recession fears. Wall Street analysts are projecting S&P companies will continue to report steady earnings growth. They forecast a % earnings growth in the third quarter. Stock Price Forecast The 33 analysts with month price forecasts for Microsoft stock have an average target of , with a low estimate of and a high. View analyst forecasts, price targets, buy/sell ratings, revenue/earnings forecasts and more.

values, consensus figures, forecasts, historical time series and news. Stock Market Forecast / - was last updated on Tuesday, August 27, Our latest investors' takes on the overall stock market and economy. Read our contributor analysis and learn how to position your portfolio going forward. In his market outlook, BMO Capital Markets' Chief Investment Strategist Brian Belski explains why the Canadian stock market will be the contrarian play. T's current price target is C$ Learn why top analysts are making this stock forecast for TELUS at MarketBeat. Outlook Therapeutics Inc. · · Partner Center · Your Watchlists · Recently Viewed Tickers · OTLK Overview · Key Data · Performance · Analyst Ratings. Sell. Ten-year yields reached our year-end target of % and fell even further before bouncing back. We expect the Fed to lower the target range for the federal. AC's current price target is C$ Learn why top analysts are making this stock forecast for Air Canada at MarketBeat. View saitpro100.ru, Inc. AMZN stock quote prices, financial information, real-time forecasts, and company news from CNN. They include data research on historical volume, price movements, latest trends and compare it with the real-time performance of the market. WalletInvestor is. The Brent crude oil spot price ended July at $81 per barrel (b), compared with an average for the month of $85/b. We expect the Brent price will return to. The average price target is $ with a high forecast of $ and a low forecast of $ The average price target represents a % change from the. As a whole, analysts are optimistic about the outlook for stock prices in The consensus analyst price target for the S&P is 5,, suggesting roughly. Russell ® Index earnings growth was close to flat year-over-year, versus negative growth rates in Industry analysts expect a sharp rebound in small-. Discover real-time Outlook Therapeutics, Inc. Common Stock (OTLK) stock prices, quotes, historical data, news, and Insights for informed trading and. Market Outlook · Jim Cramer looks closer at Carrier's latest quarter · Jim Cramer checks in on his favorite 4% yielders that could boost your portfolio · Target. Based on 28 Wall Street analysts offering 12 month price targets for Meta Platforms in the last 3 months. The average price target is $ with a high. To insert a stock price into Excel, first convert text into the Stocks data type. Then you can use another column to extract certain details relative to. Stock Screener Stock Ideas Forecast High Growth. Forecast High Growth Stocks. Companies where analysts have projected high earnings/revenue growth and positive. Stock Price Forecast The 39 analysts with month price forecasts for Meta Platforms stock have an average target of , with a low estimate of and a. Market forecasts ; S&P faces greater downside risk ahead, Bank of America says. Mon, Jul 29th ; Barclays raises S&P target to 5,, sees strong tech.