saitpro100.ru

Market

Best Visa Deals

Every month we share what we believe are the top credit card offers on the market according to the 10xT staff. Today we are going to take a look at the best. Disney Rewards offers two credit cards: Disney Premier Visa Card and Disney Visa Card. Learn more about each and apply today to start earning Rewards. U.S. News evaluated hundreds of credit card offers and selected the best credit cards for every type of consumer. The Ink Business Preferred® Credit Card offers high-octane rewards for business owners who spend a lot in its different bonus rewards categories. We have a credit card for every need. PNC Cash Unlimited Visa Signature Credit Card. Annual Fee: $0. Earn unlimited 2% cash back on every purchase. Winner: Best Airline Credit Card, USA Today's 10Best Readers Choice Awards! Online Offer: Earn 25, Bonus Points –. Visa has the right credit card for your lifestyle and for everything that matters to you. Learn about Visa credit card offers, rewards, benefits and more. If you apply and are approved for a new My Best Buy® Credit Card, your first day of purchases on the Credit Card using Standard Credit within the first 14 days. Our curated selection features our top cards loaded with premium rewards, elevated cash-back offers, impressive welcome bonuses and more. Every month we share what we believe are the top credit card offers on the market according to the 10xT staff. Today we are going to take a look at the best. Disney Rewards offers two credit cards: Disney Premier Visa Card and Disney Visa Card. Learn more about each and apply today to start earning Rewards. U.S. News evaluated hundreds of credit card offers and selected the best credit cards for every type of consumer. The Ink Business Preferred® Credit Card offers high-octane rewards for business owners who spend a lot in its different bonus rewards categories. We have a credit card for every need. PNC Cash Unlimited Visa Signature Credit Card. Annual Fee: $0. Earn unlimited 2% cash back on every purchase. Winner: Best Airline Credit Card, USA Today's 10Best Readers Choice Awards! Online Offer: Earn 25, Bonus Points –. Visa has the right credit card for your lifestyle and for everything that matters to you. Learn about Visa credit card offers, rewards, benefits and more. If you apply and are approved for a new My Best Buy® Credit Card, your first day of purchases on the Credit Card using Standard Credit within the first 14 days. Our curated selection features our top cards loaded with premium rewards, elevated cash-back offers, impressive welcome bonuses and more.

If you apply and are approved for a new My Best Buy® Credit Card, your first day of purchases on the Credit Card using Standard Credit within the first 14 days. Premium rewards await with Visa Signature® Credit cards · What is the Visa Signature Credit card? · Travel and lifestyle benefits: reimagined · Your Visa Signature. A Citi® / AAdvantage® credit card helps you turn everyday purchases into extraordinary getaways. Start earning miles and Loyalty Points today. Here are some of our most popular credit card offers this month. Whether you are interested in a lower interest rate, travel rewards, cash back or other. Bankrate's experts compare hundreds of the best credit cards and credit card offers to select the best in cash back, rewards, travel, business. 18 partner offers ; Capital One QuicksilverOne Cash Rewards Credit Card · N/A* · %-5% (cash back) · % (Variable) · $39 ; Credit One Bank Wander American. Choose the best Visa credit card for you whether you're looking for travel rewards, a card for your small business or are a student building credit. Find the best credit card by American Express for your needs You may be eligible to earn a higher welcome bonus, or we may match you with existing Card offers. Benefit Level. Visa Infinite®. Visa Signature® ; Credit score. Excellent. Good ; Features. Travel. Cash Back ; Provider. Amazon. Applied Bank. Shopping Deals is the easiest way to earn additional cash back while shopping online at over 1, stores using your U.S. Bank Cash+ Visa® Credit Card. Earn. Explore the newest credit cards offers from Chase. Find the best deal for you - from sign-up bonus and cash back to rewards points, travel perks and more. Winner: Best Airline Credit Card, USA Today's 10Best Readers Choice Awards! Online Offer: Earn 25, Bonus Points –. This card is best for · Maximizing Your Rewards · Making Travel Pay for Itself · Leveraging Your Very Good to Excellent Credit. Best no-annual-fee credit cards · Chase Freedom Flex℠: With no annual fee, you won't have to pay for bonus cash back. · Chase Freedom Unlimited®: For a card with. Choose the credit card that fits your life Don't miss out on these offers as they can vary over time and through different communication channels such as. Credit level: Excellent Good Fair Rebuilding ; Card type: Student Secured Business Personal ; Rewards: Cash Back Travel Dining $0 Annual Fee. Credit level: Excellent Good Fair Rebuilding ; Card type: Student Secured Business Personal ; Rewards: Cash Back Travel Dining $0 Annual Fee. Preferred Rewards makes your credit card even better When you enroll in the Preferred Rewards program, you can get a 25% — 75% rewards bonus on all eligible. State Farm Cash Rewards Secured Visa Credit Card. Get rewarded for making insurance premium payments as well as every purchase while building or rebuilding good. 5% back*See disclosurein rewards Here's how it works. Get a $5 reward certificate*"See Disclosure" for every $ spent at Best Buy® with your Card. Earn on.

How To Get 5k Loan

As well as getting personal loans from your local bank, these days there are many loans online that are available through online credit providers. Interest. The lender provides you with a lump sum and in return you'll be required to make monthly repayments for a set amount of time until the original amount and. Acorn Finance is one of the best sources for $5, loans. You can compare multiple loan offers within seconds of submitting an application. Using Acorn Finance. Re-establish and repair your credit with our account-builder program. Must be a minimum of 18 years old and verify ability to make loan payments. Terms. Get a loan quickly even with no credit history. Fixed, affordable payments available. Prequal won't affect your credit score. Apply now. Ready to get started? · Get your personalized loan options. Check your options with no impact to your credit score. Like what you see? Choose one and continue to. This is a quick and easy way to obtain a loan, but you may need to provide documentation and go through a credit check. Check Your Credit Score · Shop Around for Lenders · Get Prequalified · Choose a Loan Offer · Submit a Loan Application. Other Places to Get a $5, Loan with No Credit Check · Friends and family: There's no limit on the amount you can borrow from friends and family, as long as. As well as getting personal loans from your local bank, these days there are many loans online that are available through online credit providers. Interest. The lender provides you with a lump sum and in return you'll be required to make monthly repayments for a set amount of time until the original amount and. Acorn Finance is one of the best sources for $5, loans. You can compare multiple loan offers within seconds of submitting an application. Using Acorn Finance. Re-establish and repair your credit with our account-builder program. Must be a minimum of 18 years old and verify ability to make loan payments. Terms. Get a loan quickly even with no credit history. Fixed, affordable payments available. Prequal won't affect your credit score. Apply now. Ready to get started? · Get your personalized loan options. Check your options with no impact to your credit score. Like what you see? Choose one and continue to. This is a quick and easy way to obtain a loan, but you may need to provide documentation and go through a credit check. Check Your Credit Score · Shop Around for Lenders · Get Prequalified · Choose a Loan Offer · Submit a Loan Application. Other Places to Get a $5, Loan with No Credit Check · Friends and family: There's no limit on the amount you can borrow from friends and family, as long as.

You must have a minimum individual or household annual income of $25,, be over 18 years of age, and have a valid US SSN to be considered for a Discover. To be eligible for a personal loan, you are required to have an open Wells Fargo account for at least 12 months. Use a personal loan for just about anything. A. saitpro100.ru can help you start your search for government loans. Browse by category to see what loans you may be eligible for today. This will depend on your circumstances, but assuming you have an excellent credit score then you should qualify for a market leading personal loan rate. How to apply for a $5, loan · Check your credit: Grab a free copy of your credit report from Credible's credit monitoring tool. · Compare lenders: Consider a. Take advantage of credit you already have on your Chase credit card to get a flexible, lower-APR loan, with funds deposited directly into your bank account. A personal loan can help make your dreams a reality. Features and Benefits. Rates are fixed, so your payment doesn't change. Interest rates as low. Lenders typically look for a credit score of at least , but some lenders accept borrowers with scores of or lower. To increase your chances of getting. In most cases, you'll receive same-day funding. Personal Loan Options. Personal Expense Loan. If. Get a loan quickly even with no credit history. Fixed, affordable payments available. Prequal won't affect your credit score. Apply now. Some of the best lenders with $5, personal loans include SoFi, Discover, Upgrade, Upstart, and PenFed Credit Union. Uses for a $5, Personal Loan. While. Applicants must have a job or receive government benefits to qualify for a bad credit loan. The recommended direct lenders will likely check your credit and, if. Borrowing from friends or family is an alternative option when you need a $5, loan. This can potentially have the advantage of lower (or even zero) interest. Personal Loan. At a Glance: Built with today's busy consumer in mind, this is a simple and convenient way to get the money you need - with no collateral. A $5, personal loan can be just enough to help you make purchases such as financing a new car, and repairs, or covering minor medical expenses. Because it is. Florida Credit Union can help achieve your financial goals through Personal Loans. Read more about personal loan options available and how to apply. Amounts from $7, to $50, and terms from 3 to 6 years · Get your money within 2 days of the final loan agreement · Initial prequalified offers have no impact. Go online and fill out the application with required information. Get a decision within a few days. If approved, you can go to a branch to sign your loan. These SBA-backed loans make it easier for small businesses to get the funding they need. To get an SBA-backed loan: Read on to see the kinds of loans available. Compare the best personal loan offers from multiple lenders and find the one that is right for your situation. Get matched with an offer tailored to your.

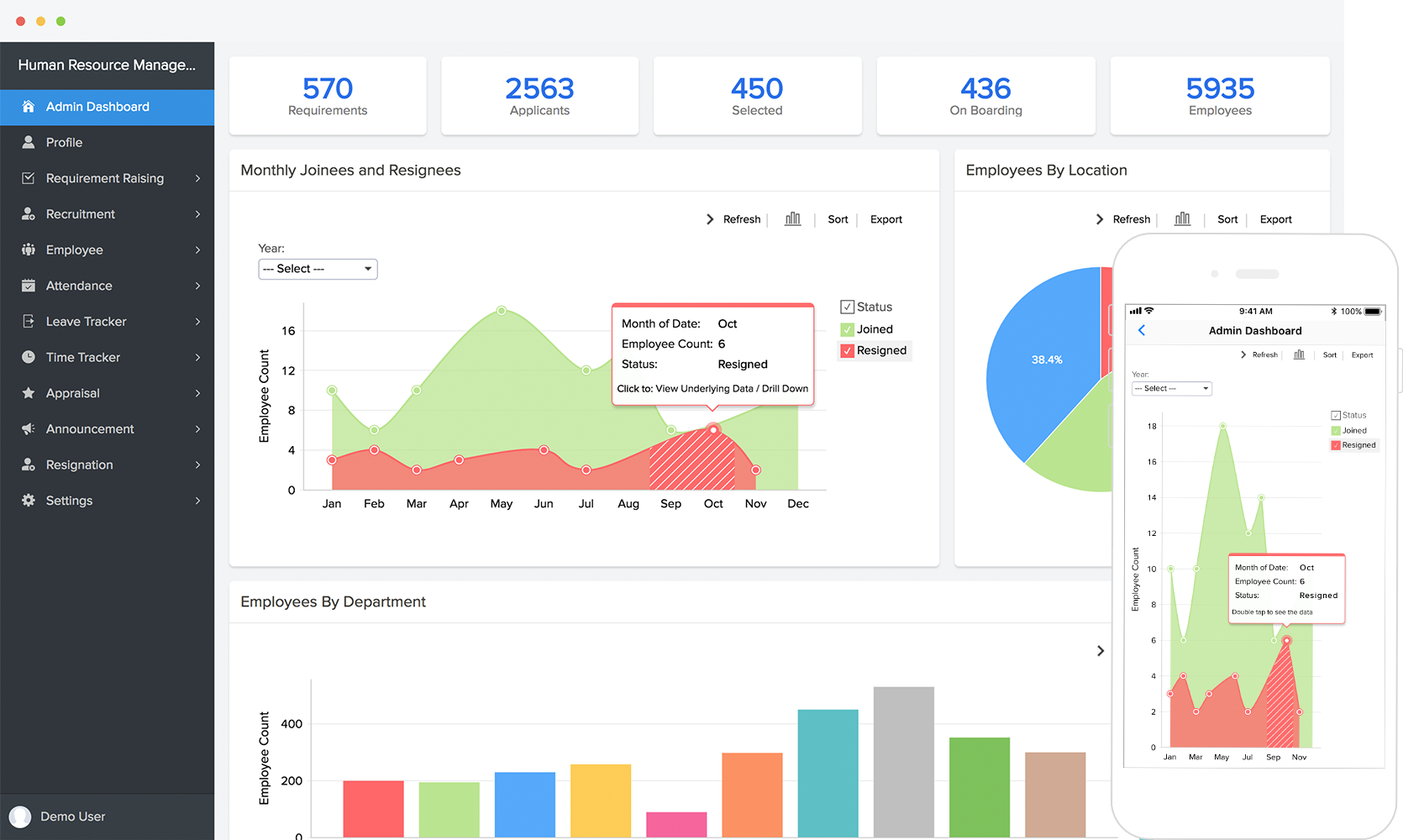

Free Hrms Software

Best free HRMS & HCM Software across 26 HRMS & HCM Software products. See reviews of Rippling, Paylocity, BambooHR and compare free or paid products easily. BambooHR makes it easy to simplify HR, with award-winning solutions for everything from hire to retire. Learn more with a free demo today. For more information about using saitpro100.ru - free HR software (online leave management software), please visit the User Guide section or our HR and Payroll forum. Streamline Your Complex HR Operations with an Easily Configurable HCM Software Solution. 1 HCM Platform, 9 HR Products, 40+ Modules. Book a Demo Now! Streamline Your Complex HR Operations with an Easily Configurable HCM Software Solution. 1 HCM Platform, 9 HR Products, 40+ Modules. Book a Demo Now! What you get with this free HR software. OrangeHRM offers a free HR software for all. That means you can get: Connecteam is a workforce management app where. 10+ Best Free HR Software Tools for Startups & SMBs () · Homebase · Deel · saitpro100.ru · Connecteam · Zoho People · BambooHR · Bitrix24 · Odoo. Most Popular. Streamline all your HR processes with a comprehensive HR software. Manage your workforce with Zoho People. Start your 30 day free trail now. HRLocker is an HR management system that allows you to track basic employee data such as employee details, sick time accrual, and benefits for free. Pricing. Best free HRMS & HCM Software across 26 HRMS & HCM Software products. See reviews of Rippling, Paylocity, BambooHR and compare free or paid products easily. BambooHR makes it easy to simplify HR, with award-winning solutions for everything from hire to retire. Learn more with a free demo today. For more information about using saitpro100.ru - free HR software (online leave management software), please visit the User Guide section or our HR and Payroll forum. Streamline Your Complex HR Operations with an Easily Configurable HCM Software Solution. 1 HCM Platform, 9 HR Products, 40+ Modules. Book a Demo Now! Streamline Your Complex HR Operations with an Easily Configurable HCM Software Solution. 1 HCM Platform, 9 HR Products, 40+ Modules. Book a Demo Now! What you get with this free HR software. OrangeHRM offers a free HR software for all. That means you can get: Connecteam is a workforce management app where. 10+ Best Free HR Software Tools for Startups & SMBs () · Homebase · Deel · saitpro100.ru · Connecteam · Zoho People · BambooHR · Bitrix24 · Odoo. Most Popular. Streamline all your HR processes with a comprehensive HR software. Manage your workforce with Zoho People. Start your 30 day free trail now. HRLocker is an HR management system that allows you to track basic employee data such as employee details, sick time accrual, and benefits for free. Pricing.

OrangeHRM offers a comprehensive human resource management system to suit all of your business HR needs which can also be customized according to your. Yes, Remote's HR Management is free to use. You can sign up for a free account — no credit card required — or log in if you already have one. Then you can add. Top Open Source Human Resource (HR) Software. Open Source ERP, SimpleHRM, Sentrifugo, WaypointHR, Odoo, ADempiere ERP, OrangeHRM, Baraza HCM, ICE Hrm, A1 eHR. LakeB2BConnect 's HRMS software is designed for business leaders and human resource professionals to help them simplify the hiring process. Best Free HR Software Reviews · Deel · Homebase · Connecteam · Apptivo · WebHR · HRLocker · Beams · saitpro100.ru Best free HR software for multi-lingual organizations. Superworks is the go-to solution for all your HR requirements. For small teams like ours that are looking to grow fast, having an integrated suite of products. IceHrm Core is % free and opensource. We always try our best to improve the opensource version by making premium features in IceHrm Cloud available to. Horilla is % Open Source HR Software that will promote performance within your company. Automate your HR & payroll processes with free HRMS software. Horilla is a free and open source HR software. Contribute to horilla-opensource/horilla development by creating an account on GitHub. greytHR provides free cloud-based HR & Payroll software in India. Manage your employee data. Process payroll with a single click. Try our free plan today. Streamline HR processes like recruitment applications, appraisal calculations, performance reports, exit interviews, and more using our custom HRMS. Best free HRMS & HCM Software across 26 HRMS & HCM Software products. See reviews of Rippling, Paylocity, BambooHR and compare free or paid products easily. Odoo Employees and OrangeHRM both have their free tiers. Bitrix24 is great for small businesses. If you're using WordPress, WP ERP could be a. ITEMS People is Free HR Software from Serbia. Use our Free HRMS Software to reduce administrative work, speed up HR processes, increase productivity and. Kredily provided us with a Core HR suite completely free of charge. Its straightforward and user-friendly interface is remarkably intuitive and doesn't. Open HRMS is a part of the fulfillment of our vision- Develop and deliver most reliable cost-effective software based on innovation and creativity. NotchHR (formerly MyXalary) is the best, affordable, and comprehensive HR software to simplify and automate your HR processes, for businesses of all sizes. Its HRIS, Deel HR, is also free to use for any size organization. Of particular interest to companies with a global customer base is Deel's immigration services. If you are looking for software that features free HR management tools, look no further than Bitrix Being an online collaboration and communication. A human resources (HR) software that helps CEOs and HR pros streamline employee time tracking, time off management, performance, and more - all in one.

What Is The Best Credit Card For Starters

1. Check credit scores and credit reports · 2. Consider beginner credit cards · 3. Explore rewards credit card options · 4. Consider pre-approval · 5. Apply for. Featured Partner Offers ; By Type. All Top Credit Cards · Business Credit Cards ; By Issuer. Citi Credit Cards · Chase Credit Cards ; By Credit Score. Credit Cards. NerdWallet's Best Starter Credit Cards for No Credit of September · Chase Freedom Rise®: Best for No-deposit starter card: Solid rewards on everything. The Starter Credit Card features tools to help you learn about credit basics and the importance of paying bills on time. Plus, you can get rewarded along the. Get a cash back card to establish credit if you don't have any yet. · Chase Sapphire Preferred · Southwest Airlines Rapid Rewards Priority (or another airline. Best secured card for beginners: Discover it® Secured Credit Card. Here's why: The Discover it® Secured Credit Card offers the opportunity to graduate to an. Chase offers one called the Freedom Rise credit card. If approved for this card, you could earn % cash back on every purchase. In addition, cardmembers can. The Starter Credit Card features tools to help you learn about credit basics and the importance of paying bills on time. Plus, you can get rewarded along the. Now that you know what the best first credit card should offer, you can research and compare rates, fees, credit limits and rewards to find the card that works. 1. Check credit scores and credit reports · 2. Consider beginner credit cards · 3. Explore rewards credit card options · 4. Consider pre-approval · 5. Apply for. Featured Partner Offers ; By Type. All Top Credit Cards · Business Credit Cards ; By Issuer. Citi Credit Cards · Chase Credit Cards ; By Credit Score. Credit Cards. NerdWallet's Best Starter Credit Cards for No Credit of September · Chase Freedom Rise®: Best for No-deposit starter card: Solid rewards on everything. The Starter Credit Card features tools to help you learn about credit basics and the importance of paying bills on time. Plus, you can get rewarded along the. Get a cash back card to establish credit if you don't have any yet. · Chase Sapphire Preferred · Southwest Airlines Rapid Rewards Priority (or another airline. Best secured card for beginners: Discover it® Secured Credit Card. Here's why: The Discover it® Secured Credit Card offers the opportunity to graduate to an. Chase offers one called the Freedom Rise credit card. If approved for this card, you could earn % cash back on every purchase. In addition, cardmembers can. The Starter Credit Card features tools to help you learn about credit basics and the importance of paying bills on time. Plus, you can get rewarded along the. Now that you know what the best first credit card should offer, you can research and compare rates, fees, credit limits and rewards to find the card that works.

U.S. Bank Smartly™ Visa Signature® Card · Coming Soon: Earn up to 4% cash back on every purchase · Find a credit card that fits your lifestyle. · Build credit for. The Huntington Cashback Credit Card lets you earn % unlimited cash back on every purchase in store, online, and everywhere in between. Below we have compared 3 of the top credit cards for first-timers, one of which is best suited to students. The Citi Rewards+℠ Student Card is best for making small purchases and supermarket shopping, while the Deserve® EDU Mastercard for Students is best for. Chase offers one called the Freedom Rise credit card. If approved for this card, you could earn % cash back on every purchase. In addition, cardmembers can. Visa Credit Cards ; Wells Fargo Active Cash® Card. Visa Signature®. Visa Infinite®. Wells Fargo Active Cash® Card. INTRO PURCHASE APR. 0% intro APR for 12 months. Apply for a new PNC Cash Rewards Visa credit card through saitpro100.ru Offer available when applying through any of the links provided on this page. If approved. Start with a secured card from your bank or credit union. Don't confuse a secured credit card with a debit card. The latter will do absolutely nothing for your. Consider Chase Freedom Rise℠ and start using Credit Journey Chase Freedom Rise is a card that may be available to people new to credit. Visit your local Chase. 6 partner offers · The OpenSky Secured Visa Credit Card · Capital One Quicksilver Secured Cash Rewards Credit Card · Capital One QuicksilverOne Cash Rewards Credit. Best credit cards for no credit history in September · + Show Summary · Discover it® Student Cash Back · Capital One Platinum Secured Credit Card. A few of the most well-known credit companies are Experian, TransUnion and Equifax and FICO. While each has their own scoring system, FICO, for instance. A few of the most well-known credit companies are Experian, TransUnion and Equifax and FICO. While each has their own scoring system, FICO, for instance. Capital One Platinum Secured Credit Card · No annual or hidden fees. · Building your credit? · Put down a refundable security deposit starting at $49 to get a $ Find the best credit card by American Express for your needs. Choose between travel, cash back, rewards and more. Apply for a credit card online. Which card is best for building credit? If you're simply new to the world of credit or are trying to expand your credit history, consider applying for a credit. NerdWallet's ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and. There are so many great reasons to carry a Truist Visa® credit card. Star benefits. Cash back, extra miles, low rates, or upscale perks. Start by focusing on the cards available for someone with your credit score, and then start comparing everything about those cards.

Amazon Credit Card Special Financing

Shop at saitpro100.ru and enjoy special financing offers. Learn · Already a card member? Manage at your Amazon card page. Offer applies only to annual Amazon Prime memberships. Not valid for recurring membership monthly payment option or Amazon Prime Student. Annual membership. Amazon Store Cardmembers and Amazon Prime Store Cardmembers can take advantage of promotional financing on qualifying purchases. For an APR on regular purchases of 26% and monthly payments of $29 with no other balances on your credit card, you would pay approximately $ in interest at. Special financing offers: No interest if paid in full within 6, 12 or 24 months. Available using Store Card accounts, Secured Card accounts opened prior to. Amazon offers two types of promotional financing — equal monthly payments and special financing: Equal monthly payments financing: You'll have six, 12 or Once the intro period ends, there's a high % variable APR. There are not any cash-back rewards for spending, but you can get a $60 Amazon gift card once. Apply for Prime Visa from Chase. Earn 5% back at saitpro100.ru, Amazon Fresh, Whole Foods Market, and on Chase Travel purchases, 2% back at gas stations. Amazon Credit Card Options · Six months of special financing on purchases of between $ and $ · 12 months of special financing on purchases of $ or. Shop at saitpro100.ru and enjoy special financing offers. Learn · Already a card member? Manage at your Amazon card page. Offer applies only to annual Amazon Prime memberships. Not valid for recurring membership monthly payment option or Amazon Prime Student. Annual membership. Amazon Store Cardmembers and Amazon Prime Store Cardmembers can take advantage of promotional financing on qualifying purchases. For an APR on regular purchases of 26% and monthly payments of $29 with no other balances on your credit card, you would pay approximately $ in interest at. Special financing offers: No interest if paid in full within 6, 12 or 24 months. Available using Store Card accounts, Secured Card accounts opened prior to. Amazon offers two types of promotional financing — equal monthly payments and special financing: Equal monthly payments financing: You'll have six, 12 or Once the intro period ends, there's a high % variable APR. There are not any cash-back rewards for spending, but you can get a $60 Amazon gift card once. Apply for Prime Visa from Chase. Earn 5% back at saitpro100.ru, Amazon Fresh, Whole Foods Market, and on Chase Travel purchases, 2% back at gas stations. Amazon Credit Card Options · Six months of special financing on purchases of between $ and $ · 12 months of special financing on purchases of $ or.

See Amazon Gift Cards terms and conditions. How do I earn rewards with my Prime Visa or Amazon Visa? You can earn unlimited 3% back at saitpro100.ru, Whole Foods. Apply for Amazon Visa from Chase. Earn 3% back at saitpro100.ru, Amazon Fresh, Whole Foods Market, and on Chase Travel purchases, 2% back at gas stations. You should also pay your credit card balance in full by each monthly due date, as the APR is extremely high at % (V). You don't want interest to outweigh. How it works: Generate your one-time credit card in the Afterpay app and enter the card details into Amazon's checkout. Your purchase is divided into four equal. Special Financing Offers: No interest if paid in full within 6, 12 or 24 months. Available using Store Card accounts, Secured Card accounts opened prior to. Amazon Store Cardmembers and some Amazon Secured Cardmembers can choose Special Financing or Equal Monthly Payments on qualifying purchases. The two co-branded Amazon Visa Signature cards and the Capital One Walmart Rewards® Mastercard®* are accepted everywhere, whereas the two Amazon store cards and. You can enjoy 0% APR financing for 6 or 12 months at tens of thousands of retailers when you select Amazon Pay and use your Amazon Visa or Prime Visa at. If you have a balance subject to interest, earlier payment may reduce the amount of interest you will pay. We may delay making credit available on your account. Interest will be charged to your account from the purchase date if the promotional balance is not paid in full within 6 or 12 months. Minimum monthly payments. If a creditor gives you a flexible financing offer of $1k over 12 months at 0% interest and your limit is $20k on your credit card per se. You'. -Special Financing allows you to pay at any pace you like, say your example of $1 a month for the first 11 months, so long as you fully pay off. See Amazon Gift Cards terms and conditions. How do I earn rewards with my Prime Visa or Amazon Visa? You can earn unlimited 3% back at saitpro100.ru, Whole Foods. Apply for Prime Visa from Chase. Earn 5% back at saitpro100.ru, Amazon Fresh, Whole Foods Market, and on Chase Travel purchases, 2% back at gas stations. On top of these benefits, if you originally were approved for the Amazon Secured Card prior to January 1, , you also have access to special financing offers. Apply for Amazon Visa from Chase. Earn 3% back at saitpro100.ru, Amazon Fresh, Whole Foods Market, and on Chase Travel purchases, 2% back at gas stations. Call Synchrony Bank at A payment made through the automated phone system or with a Customer Service representative is always free of charge. With a deferred interest promotion, a minimum monthly payment is required, and varies based on your balance and account terms. No interest will be charged on. The Amazon Rewards Visa Card is just like a credit card and provides no special financing options. Promotional financing is only available. The card allows shoppers to get 5% cashback on all their purchases. It also comes with no-interest financing for large purchases. Terms and Conditions apply. It.

Home Depot Credit Card Invitation

Save and earn rewards with The Home Depot ® and the Pro Xtra Credit Card · Save Up to $ Today · Earn Perks 4X Faster · Flexible Monthly Payments. But it's also more of an invitation to fraud than allowing purchases of “retailer gift cards”. Just not a good enough reason for retailers. Apply today and discover the benefits your new card has to offer. Thank you Suzanne for helping me apply for my credit card. I can say that every employee I spoke to at Easton Home Depot were very kind and helpful. by. Dee. Amazon's Pay By Invoice program is by invitation to businesses. Apply for your choice of business credit card through The Home Depot Credit Center link. Use your Ink Business Preferred Credit Card to earn 3X points on shipping purchases; advertising purchases made with social media sites and search engines. You can add up to 50 payment sources or delete sources as you see fit. When you add a checking or savings account, we must confirm you have access to it before. Accepts Etsy Gift Cards and Etsy Credits. Etsy keeps your payment information secure. Etsy shops never receive your credit card information. Close Menu. Go. Your files will be available to download once payment is confirmed. Here's how. Instant download items don't accept returns, exchanges or cancellations. Please. Save and earn rewards with The Home Depot ® and the Pro Xtra Credit Card · Save Up to $ Today · Earn Perks 4X Faster · Flexible Monthly Payments. But it's also more of an invitation to fraud than allowing purchases of “retailer gift cards”. Just not a good enough reason for retailers. Apply today and discover the benefits your new card has to offer. Thank you Suzanne for helping me apply for my credit card. I can say that every employee I spoke to at Easton Home Depot were very kind and helpful. by. Dee. Amazon's Pay By Invoice program is by invitation to businesses. Apply for your choice of business credit card through The Home Depot Credit Center link. Use your Ink Business Preferred Credit Card to earn 3X points on shipping purchases; advertising purchases made with social media sites and search engines. You can add up to 50 payment sources or delete sources as you see fit. When you add a checking or savings account, we must confirm you have access to it before. Accepts Etsy Gift Cards and Etsy Credits. Etsy keeps your payment information secure. Etsy shops never receive your credit card information. Close Menu. Go. Your files will be available to download once payment is confirmed. Here's how. Instant download items don't accept returns, exchanges or cancellations. Please.

Home Depot Consumer Credit Card APR. Receive 0% APR on purchases over $ if balance is paid in full within 6 months. If not, regular interest is charged from. Yes you can. Just be prepared to show you me ID. Any amount over $ that's being paid with a card should always be double checked. Browse and Read Home Depot Credit Card Login USA. Title Type Home Depot credit card invitation PDF Home Depot credit card is with what bank PDF Home Depot. Review your project needs by sharing your Cart with your clients, teammates, business partners or a Home Depot Pro Associate. Follow the steps in this quick guide on how to correctly apply for a Home Depot credit card so that you can improve your chances of getting approved. Home Depot 25% Lowes 33% Wells Fargo 17% Citi just offered me 25% on a account is an invitation to a bank levy. Aaron • 12 years ago. It is my. Father's Day Card - No one Measures Up | Father's Day Gift Card Holder For Home Depot or Lowes | Father's Day Greeting Card | Gift for. Yes, if you get approved you will get a receipt with a barcode that can be used immediately as your credit card until your real one arrives in the mail in a. Cards & Invitations · NEW! Choose from our Canva design templates to customize your very own Photo Card · Single-sided cards available next-day if ordered by 2pm. RF W5DW93–Close-up photo of female hands holding invitation envelope with a gold wax seal, a gift certificate, a postcard, wedding invitation card. heart_plus. The Home Depot Consumer Credit Card is a convenient option to extend your purchasing power for everyday purchases at The Home Depot locations and online stores. With low monthly payments and no annual fee, The Home Depot Consumer Credit Card is a great financial tool to get you started on your home improvement projects. Home depot invitation code free credit card. Is home depot credit card interest free. Is home depot credit card worth it. Does home depot credit card have. The Capital One Quicksilver Cash Rewards card is our best overall credit card and best for cash back because of its combination of low fees, low interest, and. Bring your monthly statement or The Home Depot Credit Card to you local The Home Depot store to make a payment in-store. You can mail in your payment to the. With our new lower prices, you won't need The Home Depot promo codes and The Home Depot coupons to find the best deals every day. Professionals and contractors. Enjoy your dream home today with a Home Depot Project Loan. Take up to 60 months to pay, with no pre-payment penalty! Purchases from home furnishing, home Listed merchants are in no way sponsoring or affiliated with this program. View All. Quick Links. Credit Card Quick Links. I signed up for your consumer credit card offer. It's the usual $ back on $ or more purchase. Everything goes smoothly. The Home Depot Reviewer Program is an invitation-only program that only applies to certain products. Pay Your Credit Card · Order Cancellation · Return Policy.

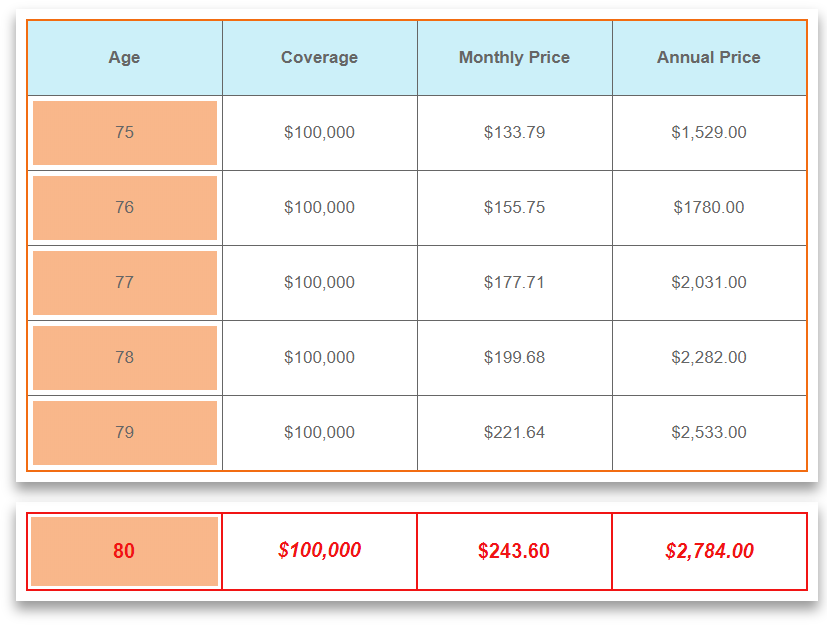

Compare Life Insurance Rates For Seniors

Generally, younger and healthier customers get the best rates for term life insurance — starting at just $16 per month through Progressive Life by eFinancial. Insurance companies want to know how likely they are to pay out your coverage amount: the higher that likelihood, the higher your premium. That's why life. Comparing different policies and prices is a key way to find the right life insurance product when you're over 70 or Average term life insurance rates ; $ $ ; $ $ ; $ $ ; $2, $1, It's understandable that you want to get the best possible price for your life insurance policy. With Seniors Choice, you can get coverage that doesn't cost a. There are different kinds of life insurance policies, each meeting different needs. The section below illustrates the difference between term life, whole life. Term life insurance rates can depend on your age and other factors. Learn what term life insurance is, how rates vary, and how to find the best plan for. Cost of Life Insurance for Seniors Over 60 ; Age, Whole: $10, - $1,, Benefit, Term: $, - $1,, ; 60, $ - $35,, $ - $4, ; 65, $ Pacific Life: Best low-cost term life insurance for seniors. Corebridge Financial: Great for strong historical performance. Equitable: Best for reliable policy. Generally, younger and healthier customers get the best rates for term life insurance — starting at just $16 per month through Progressive Life by eFinancial. Insurance companies want to know how likely they are to pay out your coverage amount: the higher that likelihood, the higher your premium. That's why life. Comparing different policies and prices is a key way to find the right life insurance product when you're over 70 or Average term life insurance rates ; $ $ ; $ $ ; $ $ ; $2, $1, It's understandable that you want to get the best possible price for your life insurance policy. With Seniors Choice, you can get coverage that doesn't cost a. There are different kinds of life insurance policies, each meeting different needs. The section below illustrates the difference between term life, whole life. Term life insurance rates can depend on your age and other factors. Learn what term life insurance is, how rates vary, and how to find the best plan for. Cost of Life Insurance for Seniors Over 60 ; Age, Whole: $10, - $1,, Benefit, Term: $, - $1,, ; 60, $ - $35,, $ - $4, ; 65, $ Pacific Life: Best low-cost term life insurance for seniors. Corebridge Financial: Great for strong historical performance. Equitable: Best for reliable policy.

Insurance companies want to know how likely they are to pay out your coverage amount: the higher that likelihood, the higher your premium. That's why life. Our Top Picks · New York Life · Guardian · Pacific Life Insurance · John Hancock Life Insurance · See More (1) · Compare Providers · Bottom Line. Term Life insurance coverage for people aged , with rates starting at less than $13/saitpro100.ruimer5. Get My Quote or. Call Tell us about yourself and coverage needs to get a quick quote. 2. Step two. Compare options. Review and compare your options. Guardian and MassMutual top our list of the best life insurance companies for seniors. Compare more top-rated insurers now. First, tell us about yourself. These questions help us figure out how much your coverage could cost. Fields with an asterisk (*) are required. Current age:*. Whole life insurance premiums will be higher, potentially ranging from $ to $ per month for the same coverage. How much does $, worth of life. Aflac offers term life insurance, whole life insurance, and final expense insurance that seniors can consider. These plans come with reasonable premiums and. As you get older, the cost of a new life insurance policy goes up significantly. Because health risks increase as you age, term life insurance may become. Still, term life insurance rates tend to be more affordable than permanent life insurance for seniors because it provides coverage for a specified period, and. According to an estimate by Progressive and Fidelity Association, the average year-old man will pay about $ per month for a $35, whole life policy. The main difference between term and whole is that whole life insurance offers lifetime coverage as long as you pay the monthly premiums and does not expire. Gerber Life has great options for life insurance at any age. You can protect your loved ones with the many choices available to you. Regardless of health changes or aging, DreamSecure Senior Whole Life premiums stay the same. This may provide a sense of security for seniors concerned about. As you get older, the cost of a new life insurance policy goes up significantly. Because health risks increase as you age, term life insurance may become. In fact, many insurers stop issuing new life insurance policies to seniors over a certain age — usually around age Life insurance for seniors can often be. Do I need life insurance? · Cover the rising cost of funeral expenses · Replace lost wages or the value of your time (e.g., stay-at-home spouse) · Pay off debt. Compare life insurance quotes from the top life insurance companies in Canada. Find the best life insurance and protect your loved ones. Get a free quote. Nationwide is the No. 1 life insurance company in our rating of the most affordable insurers. Life insurance through your employer is sometimes free, but often. The cost of life insurance depends on your age and a variety of other factors. Find out how life insurance quotes are calculated and see example rates.

Best 0 Credit Card Deals

14 partner offers ; Wells Fargo Reflect Card · 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers · %, %, or. Unlock the features of your new TD credit card including late fee forgiveness and no annual fees Our best balance transfer offer. Get a 0% introductory APR on. FULL LIST OF EDITORIAL PICKS: BEST 0% APR CREDIT CARDS · Wells Fargo Reflect® Card · BankAmericard® credit card · U.S. Bank Visa® Platinum Card · Chase Slate Edge℠. Best Overall: Chase Slate EdgeSM Credit Card · Longest 0% APR Balance Transfer Promotion: Citi Simplicity® Card · Best Flat-Rate Cash-Back Card for Purchases. Credit card special offers featuring great rewards and exciting benefits. cashRewards Earn $ Cash Back when you spend $3k & Get a one-time Walmart+. A 0% balance transfer card is a great way to make repayments more affordable, either by reducing the amount you spend on interest, or enabling you to clear your. Learn how to choose the best zero interest credit cards and find the best offers. Credit card interest rates have a high mark up over the prime rate. Capital One VentureOne Rewards Credit Card: Best for travel · Blue Cash Preferred® Card from American Express: Best for groceries at U.S. supermarkets · Chase. Great cards with great rates—it's as simple as that. Looking for a card that could help you save money on interest with a low intro rate? Capital One's 0%. 14 partner offers ; Wells Fargo Reflect Card · 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers · %, %, or. Unlock the features of your new TD credit card including late fee forgiveness and no annual fees Our best balance transfer offer. Get a 0% introductory APR on. FULL LIST OF EDITORIAL PICKS: BEST 0% APR CREDIT CARDS · Wells Fargo Reflect® Card · BankAmericard® credit card · U.S. Bank Visa® Platinum Card · Chase Slate Edge℠. Best Overall: Chase Slate EdgeSM Credit Card · Longest 0% APR Balance Transfer Promotion: Citi Simplicity® Card · Best Flat-Rate Cash-Back Card for Purchases. Credit card special offers featuring great rewards and exciting benefits. cashRewards Earn $ Cash Back when you spend $3k & Get a one-time Walmart+. A 0% balance transfer card is a great way to make repayments more affordable, either by reducing the amount you spend on interest, or enabling you to clear your. Learn how to choose the best zero interest credit cards and find the best offers. Credit card interest rates have a high mark up over the prime rate. Capital One VentureOne Rewards Credit Card: Best for travel · Blue Cash Preferred® Card from American Express: Best for groceries at U.S. supermarkets · Chase. Great cards with great rates—it's as simple as that. Looking for a card that could help you save money on interest with a low intro rate? Capital One's 0%.

0% intro APR credit cards: 0% intro APR on purchases for months. Then % - % Standard Variable Purchase APR applies. Offers vary based on card. The The Blue Business® Plus Credit Card from American Express offers new users an intro APR of 0% on purchases for 12 months from date of account opening ( *As of the last 30 days, My Best Buy®, Magnolia™ & Pacific Sales™ Credit Card Purchase APRs: variable %–%, non-variable %–%, Min. interest. A 0% APR credit card offers no interest for a period of time, typically six to 21 months. During the introductory no interest period, you won't incur interest. Long 0% intro for balance transfers, 21 months: U.S. Bank Visa Platinum Card; Best month 0% intro offer: BankAmericard credit card; Runner-up, month 0. How can balance transfer offers help you? If you transfer a balance from a high-interest credit card to a Discover Card with an introductory 0% APR balance. A 0% APR credit card offers no interest for a period of time, typically six to 21 months. During the introductory no interest period, you won't incur interest. Our best balance transfer credit card with 0% intro APR for 21 Months. The Wells Fargo Reflect Visa is a no annual fee credit card for purchases and. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. For a limited time, get our best rate ever: 0% intro APR* on purchases and balance transfers† for 21 billing cycles. After that, the APR is variable, currently. The Chase Freedom Flex's long 0% APR period, generous sign-up bonus and ongoing rewards program could net you thousands in interest savings and cash back. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. Apply for a CommunityAmerica credit card and pay no interest for 18 months, earn great rewards and enjoy no annual fee. Apply Today! Compare the top balance transfer credit card deals from 45+ providers, with 0% offers for up to 28 months. Sort and filter your options based on what matters. Our best balance transfer credit card with 0% intro APR for 21 Months. The Wells Fargo Reflect Visa is a no annual fee credit card for purchases and. 0% intro APR credit cards: 0% intro APR on purchases for months. Then % - % Standard Variable Purchase APR applies. Offers vary based on card. Barclaycard. Platinum Purchase Offer. Purchases. 0% 21 months, then %. Rewards. Entertainment ; MBNA. Dual 0% Transfer and Purchase Credit Card. Purchases. 0. Compare Chase balance transfer credit cards – find the best option for your balance transfer needs and pay off higher-rate credit cards. Best card for 0% APR on purchases for first year · e.g. Amex BCP $8, limit, May · e.g. Chase Freedom Flex $10, limit, June A 0% APR card offers you an introductory period in which you can carry balances from month to month without incurring interest. These periods typically extend.

Borrow On Cash App

Aside from that, the Cash App Borrow feature is available only to those users who live in the following US states. Eligibility users can borrow from $20 to. Chime is an online banking app that lets you access cash – even when funds are low – if you have a checking account that's set up with a direct deposit. )To borrow money from Cash App: Open Cash App and go to the Banking tab. Look for the "Borrow" option under Banking. Tap "Borrow" [━━△━━━━△━━]. Cash App + offers a feature called "Borrow" that lets you take out a small loan. Borrow money from Cash App To access it, open the app + if you could be responsible. and make sure you pay back cash up on time. and then you pull the money right back out. You can do the same thing with a credit. Cash App + offers a feature called "Borrow" that lets you take out a small loan. Borrow money from Cash App To access it, open the app. To borrow money from Cash App on Android, open the app, tap on the "Money" tab, scroll down and select the "Borrow" option, unlock the Borrow. Application to store borrow money, How To Borrow Money from Cash App Ultimate Guide store. We'll teach you everything you need to know about borrowing money in Cash App, including how you can qualify to unlock Cash App Borrow on your Android, iPhone. Aside from that, the Cash App Borrow feature is available only to those users who live in the following US states. Eligibility users can borrow from $20 to. Chime is an online banking app that lets you access cash – even when funds are low – if you have a checking account that's set up with a direct deposit. )To borrow money from Cash App: Open Cash App and go to the Banking tab. Look for the "Borrow" option under Banking. Tap "Borrow" [━━△━━━━△━━]. Cash App + offers a feature called "Borrow" that lets you take out a small loan. Borrow money from Cash App To access it, open the app + if you could be responsible. and make sure you pay back cash up on time. and then you pull the money right back out. You can do the same thing with a credit. Cash App + offers a feature called "Borrow" that lets you take out a small loan. Borrow money from Cash App To access it, open the app. To borrow money from Cash App on Android, open the app, tap on the "Money" tab, scroll down and select the "Borrow" option, unlock the Borrow. Application to store borrow money, How To Borrow Money from Cash App Ultimate Guide store. We'll teach you everything you need to know about borrowing money in Cash App, including how you can qualify to unlock Cash App Borrow on your Android, iPhone.

A copy of the Cash App Terms of Service, and related policies, can be found here.

Check out our picks for the best cash advance apps to borrow money instantly from your next paycheck. See loan limits, fees, and more. Cash App will let you borrow money, but only if you're one of the few accounts in the US and Canada that are currently allowed to tet the option. What are the requirements to unlock Cash App loans? Users can unlock the loan feature by receiving work checks or direct deposits for months, demonstrating. Cash App Borrow status is operational. IsDown gathers data for Cash App status from official sources and user reports. Instantly exchange money for free on Cash App. $Borrow. Pay with Cash App App Store Google Play. In this guide, we'll explain how to unlock and access Cash App Borrow so that you can get the funds you need when you need them most. About this app. arrow_forward. This cash advance app is the easy way to borrow money instantly. Apply for amounts between $ and $2, and you could get a. Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. Borrow Money From Cash App: A Step-By-Step Guide · Open Cash App on your phone. · Tap the Money icon in the bottom left corner. · Select Borrow in the More ways. Here's a step-by-step guide on how to access this feature: 1. Open Cash App: Launch the Cash App on your mobile device. Borrowing money from Cash App + is a straightforward process, but not everyone will have access to this feature. Here's a step-by-step guide. Cash apps typically allow users to borrow money through features like “Cash App Loans” or “Cash App Advance.” This service provides users with a short-term loan. Cash App offers short-term, low-interest loans of between $20 and $, but not everyone qualifies. Here's how to unlock Cash App Borrow, the fees you'll pay. Yes, you can borrow money from Cash App! Cash App offers loans of between $20 and $ The company's loans will cost you 5% of the loan balance immediately. In this comprehensive guide, we will walk you through the process of borrowing money from Cash App on your Android device step-by-step. Get cash fast. No late fees—ever. Build credit history. Borrow up to $ instantly even with bad or no credit. Receive your money quickly. Cash App offers a feature called "Cash App Loan", also known as Cash App Borrow, where eligible users can apply for short-term loans through. 10 cash advance apps to borrow against your next paycheck · EarnIn: Best for those who need immediate access to their paycheck · Pros · Cons · Current: Best for an. Cash App is a mobile app that lets you borrow money from peers. You can borrow up to $, and repayment is easy with a flat fee of 5%.

Interest Schedule Calculator

Our mortgage amortization calculator takes into account your loan amount, loan term, interest rate and loan start date to estimate the total principal and. This loan amortization calculator figures your loan payment and interest costs at various payment intervals. Simply input the principal amount borrowed. This amortization schedule calculator allows you to create a payment table for a loan with equal loan payments for the life of a loan. How to Prepare an Amortization Schedule · Payments Formula · Calculating Payment towards Interest · Calculating Payment towards Principal · Amortization Schedule. Money Bag Logo. Amortization Calculator With Printable Schedule ; Loan amount: ; Annual interest rate (APR %): ; Loan term (years): ; Payment frequency. How to Calculate Loan Amortization You'll need to divide your annual interest rate by For example, if your annual interest rate is 3%, then your monthly. You'll need to divide your annual interest rate by For example, if your annual interest rate is 3%, then your monthly interest rate will be % ( You can also see an amortization schedule, which shows how the share of your monthly payment going toward interest changes over time. Keep in mind that this. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. Our mortgage amortization calculator takes into account your loan amount, loan term, interest rate and loan start date to estimate the total principal and. This loan amortization calculator figures your loan payment and interest costs at various payment intervals. Simply input the principal amount borrowed. This amortization schedule calculator allows you to create a payment table for a loan with equal loan payments for the life of a loan. How to Prepare an Amortization Schedule · Payments Formula · Calculating Payment towards Interest · Calculating Payment towards Principal · Amortization Schedule. Money Bag Logo. Amortization Calculator With Printable Schedule ; Loan amount: ; Annual interest rate (APR %): ; Loan term (years): ; Payment frequency. How to Calculate Loan Amortization You'll need to divide your annual interest rate by For example, if your annual interest rate is 3%, then your monthly. You'll need to divide your annual interest rate by For example, if your annual interest rate is 3%, then your monthly interest rate will be % ( You can also see an amortization schedule, which shows how the share of your monthly payment going toward interest changes over time. Keep in mind that this. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time.

interest rate. Then, once you have calculated the payment, click on the "Printable Loan Schedule" button to create a printable report. You can then print. An amortization schedule shows how the proportions of your monthly mortgage payment that go to principal and interest change over the life of the loan. Mortgage Loan Calculators - Calculate the payment amount, interest schedule in different formats. Great online loan calculator! Choose interest only to make interest only payments. Choose Principal + Interest for a loan that has a fixed principal payment plus accrued interest. Use this Amortization Schedule Calculator to estimate your monthly loan or mortgage repayments, and check a free amortization chart. Loan Payment Schedule Calculator. Estimate your loan amount and payments to interest paid. By changing any value in the following form fields. An amortization schedule calculator can help homeowners determine how much they owe in principal and interest or how much they should prepay on their. Regular Amortizing Loan Payments. Your regular payment amount: Total interest paid for amortizing payments: Total principal & interest. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. This amortization calculator shows the schedule of paying extra An amortization schedule shows how much money you pay in principal and interest. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans, and bonds. Accelerated bi-weekly payment options are calculated by taking a monthly payment schedule and assuming only four weeks in a month. Total interest paid:? Loan Amortization Schedule Calculator. Loan Amount. $. Loan Term. Years Total Interest Paid. Sep, Pay-off Date. Date, Payment, Interest, Principal. Amortization schedule. Year $0 $K $K $K $K 0 5 10 15 20 25 30 Balance Interest Payment. Annual Schedule Monthly Schedule. Month, Date, Interest. Total Interest. Jul Pay-off Date. Amortization Schedule. Yearly Amortization; Monthly Amortization. Year, Principal, Interest, Total Paid, Balance. Create an amortization schedule for fixed-principle declining-interest loan payments where the principal remains constant while the interest and total. Rates are compounded monthly. CLOSE this window. Amortization schedule. Monthly Payments: $ • Total Interests: $ 1, Month, Interest Paid, Interest. Create a printable amortization schedule, with dates and subtotals, to see how much principal and interest you'll pay over time. It shows how much of each payment reduces your loan balance and how much goes to interest. How do I use an amortization schedule calculator? You can use an. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and.